Jeffrey Immelt, CEO of the company famous for  making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has endorsed the recently proposed amnesty for corporate tax dodgers, called a “repatriation holiday” by its proponents.

making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has endorsed the recently proposed amnesty for corporate tax dodgers, called a “repatriation holiday” by its proponents.

Immelt was selected by President Barack Obama in February of 2009 to chair his Council on Jobs and Competitiveness, which is to advise the White House on economic policy. He has been CEO of General Electric since 2000.

In March, the New York Times reported GE’s federal corporate income tax bill of negative $4.1 billion over the five-year period in which it earned $26 billion in profits, which is an effective tax rate of negative 15.8 percent. A recent report from CTJ focuses on the three-year period 2008-2010 and finds that GE earned $7.7 billion in profits during this period and had a federal corporate income tax bill of negative $4.7 billion over this period.

Following the New York Times revelations, progressive activists spearheaded a call for Immelt’s resignation from the President’s Council on Jobs and Competitiveness.

His call for an amnesty for offshore tax dodgers will surely give more ammunition to those demanding that he step down from the Council.

What Does an Infrastructure Bank Have to Do with an Amnesty for Corporate Tax Dodgers? Nothing.

A repatriation holiday is essentially a break from U.S. corporate income taxes on offshore profits that U.S. corporations bring back (repatriate) from foreign countries, particularly from tax havens.

The non-partisan Joint Committee on Taxation (JCT), the official revenue-estimator for Congress, has concluded that a repeat of the repatriation holiday that was enacted in 2004 would reduce revenue by $79 billion over ten years.

Yet Immelt, confusingly, says that a repatriation holiday could be used to fund an infrastructure bank. How can a measure that reduces revenue be used to fund anything?

It’s true that JCT finds that the holiday would raise some revenue initially because corporations would repatriate more profits to the U.S. than they normally would, and they would be taxed, albeit at a very low rate, on those profits. (The 2004 measure taxed repatriated offshore profits of U.S. corporations at a super-low rate of 5.25 percent.)

But in subsequent years the measure would cause much larger reductions in revenue, partly because corporations would be encouraged to shift even more profits and investments offshore.

Anything that costs $79 billion and encourages companies to shift even more profits and investments out of the U.S. has nothing to do with the goals of an infrastructure bank and should not be attached to any bill creating an infrastructure bank.

The infrastructure bank is supposed to create jobs, but the non-partisan Congressional Research Service (CRS) found that the repatriation holiday enacted in 2004 failed to create jobs and that the benefits went instead to corporate shareholders.

Read about how you can call your Senators and Representatives toll-free and urge them to oppose the amnesty for corporate tax dodgers.

Photo via Steve Wilhelm Creative Commons Attribution License 2.0

President’s and GOP’s Positions Both Include Greater Tax Cuts than Spending Cuts

President’s and GOP’s Positions Both Include Greater Tax Cuts than Spending Cuts

Iowa’s roads and the revenue sources used to pay for those roads. More specifically, the Commission is seeking to address what the state’s Department of Transportation estimates is a $215 million shortfall in transportation spending, relative to the amount of money needed to complete certain high-priority projects.

Iowa’s roads and the revenue sources used to pay for those roads. More specifically, the Commission is seeking to address what the state’s Department of Transportation estimates is a $215 million shortfall in transportation spending, relative to the amount of money needed to complete certain high-priority projects.  offered a

offered a  that shutdown continues, nearly two weeks later, as a result of a stand off between Governor Mark Dayton and conservatives in the state’s legislature.

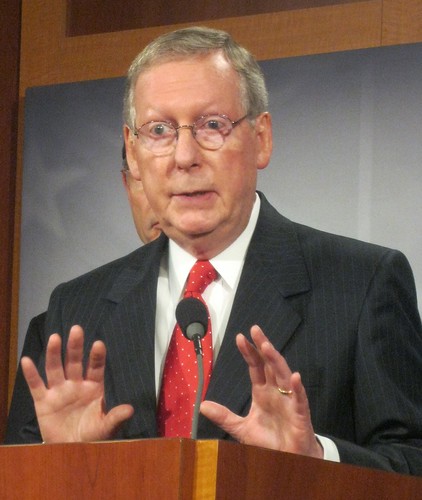

that shutdown continues, nearly two weeks later, as a result of a stand off between Governor Mark Dayton and conservatives in the state’s legislature. Senator McConnell’s convoluted proposal for lawmakers to raise the debt ceiling while avoiding the blame (

Senator McConnell’s convoluted proposal for lawmakers to raise the debt ceiling while avoiding the blame ( making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has

making profits of $26 billion from 2006 through 2010 and receiving tax benefits from the IRS of $4.1 billion over that period, has  was ultimately unsuccessful in his

was ultimately unsuccessful in his  Republican leaders in the House and Senate have threatened to allow the U.S. to default on its debt obligations unless the President agrees to cut trillions from public services to reduce the budget deficit.

Republican leaders in the House and Senate have threatened to allow the U.S. to default on its debt obligations unless the President agrees to cut trillions from public services to reduce the budget deficit.