April 1, 2013 06:08 PM | Permalink | ![]()

(For more details, see the accompanying report.)

Click on Charts to See High Quality Version.

It is sometimes claimed that many low- and middle-income Americans don’t pay taxes while the richest Americans pay a hugely disproportionate share of taxes, especially after enactment of the “fiscal cliff” deal that allowed some taxes to go up.

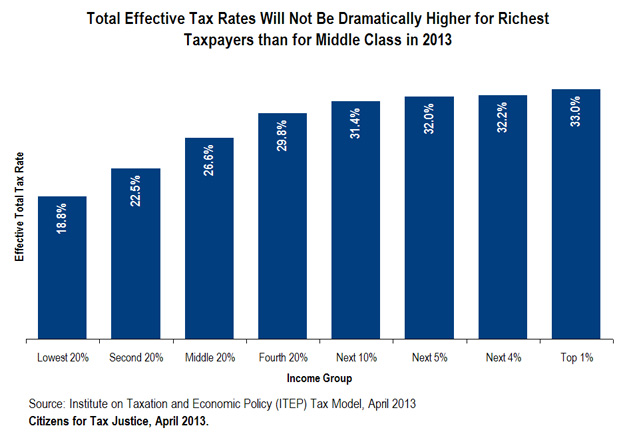

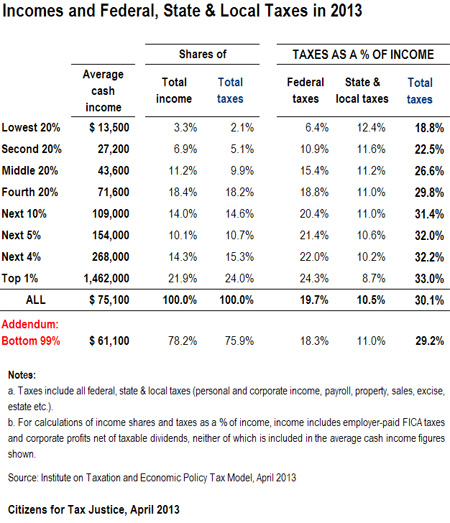

As the table to the right illustrates, America’s tax system is just barely progressive even after the fiscal cliff deal’s effects. Claims that the rich pay a disproportionate share of taxes often focus only on the federal personal income tax and ignore the other taxes that people pay, like federal payroll taxes, federal excise taxes, and state and local taxes. Many of these other taxes are regressive, meaning they take a larger share of income from poor and middle-income families than they take from the rich.

the right illustrates, America’s tax system is just barely progressive even after the fiscal cliff deal’s effects. Claims that the rich pay a disproportionate share of taxes often focus only on the federal personal income tax and ignore the other taxes that people pay, like federal payroll taxes, federal excise taxes, and state and local taxes. Many of these other taxes are regressive, meaning they take a larger share of income from poor and middle-income families than they take from the rich.

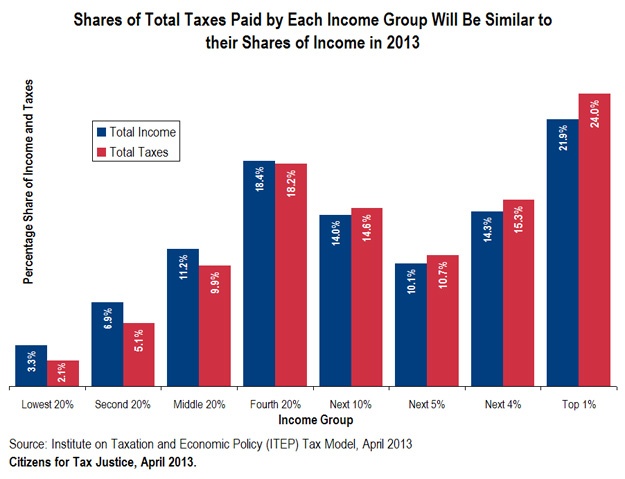

The table shows the share of total taxes (all federal, state and local taxes) that will be paid by Americans in different income groups in tax year 2013.

■ Each income group will pay a share of total taxes that is very similar to the share of total income received by that group.

■ The richest one percent of Americans will pay 24 percent of total taxes and receive 21.9 percent of total income.

■ The poorest fifth of Americans will pay 2.1 percent of total taxes and receive 3.3 percent of total income.

■ The effective total tax rate for the richest one percent of Americans will be 33 percent, compared to 26.6 percent for the middle fifth of Americans.

Everyone in America pays taxes. Everyone who works pays federal payroll taxes. Everyone who buys gasoline pays federal and state gas taxes. People who shop in stores pay the sales taxes that most state and local governments impose. State and local property taxes affect everyone who owns or rents a home. (Even renters pay property taxes because landlords pass some of the tax on to them in the form of higher rents). Most states also have income taxes, most of which are not particularly progressive.

Progressivity Needed to Offset Regressive Taxes

To offset the regressive impact of these taxes, we need taxes that are more progressive. Some federal taxes have features that accomplish this, at least to a degree. For example, the federal personal income tax provides refundable tax credits like the Earned Income Tax Credit and the Child Tax Credit, which can reduce or eliminate personal income tax liability for working families and even result in negative personal income tax liability, meaning families receive a check from the IRS.

These tax credits are only available to taxpayers who work, and who therefore pay federal payroll taxes, not to mention the other taxes that disproportionately affect low- and middle-income Americans.

In other words, the parts of the federal personal income tax that may seem like boons to the poor are justified not only by kindness, but also because they offset some of the other taxes that poor and middle-income families must pay.

Recent Tax Changes Have Only Modest Progressive Impact

Tax changes that took effect in 2013, allowing parts of the Bush-era cuts in the federal personal income tax to expire and an increase in the Medicare Hospital Insurance (HI) tax, did make the rich pay higher taxes than they had in earlier years. But the fiscal cliff deal also did not extend a temporary payroll tax break, which had particularly helped low- and middle-income working people in 2011 and 2012.

To see how the distribution of taxes would have been different if Congress had extended all the tax laws in effect in 2012, see the accompanying report: www.ctj.org/pdf/taxday2013report.pdf