November 3, 2015 01:38 PM | Permalink | ![]()

Update March 9th, 2016: Click here or scroll down to see a new addendum showing the cost of Rubio’s tax plan with alternative assumptions regarding his proposed refundable credit and his treatment of personal exemptions.

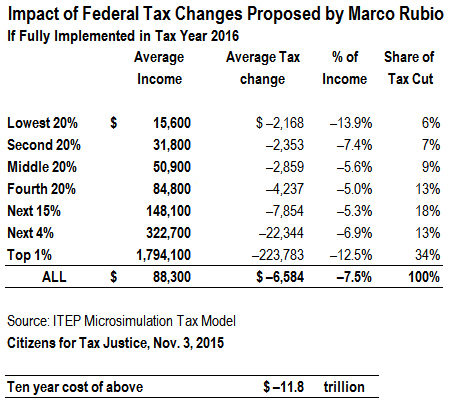

A new Citizens for Tax Justice analysis of Marco Rubio’s tax plan reveals that it would add $11.8 trillion to the national debt over a decade. More than a third of Rubio’s tax cuts would go to the best-off 1 percent of Americans.

What the Rubio Plan Would Do

Rubio’s tax plan includes major changes to both the personal and corporate income taxes.

Under Rubio’s plan, every income group would receive a tax cut. As a share of income, the top 1 percent would collectively see a tax cut equal to 12.5 percent of their average income, more than two times as big as the tax changes as a share of income enjoyed by the middle 20 percent of Americans, who would get a tax cut equal to 5.6 percent of their income.

The bottom 20 percent would receive a substantial cut of 13.9 percent as a percentage of their income due to Rubio’s creation of a $2,000 refundable tax credit for singles and $4,000 for married couples in place of the standard deduction, along with a huge expansion of the partially refundable per-child credit. CTJ’s modeling assumes that the standard credits would be fully refundable based on Rubio’s latest description of his tax plan.[i] Despite Rubio’s promise, however, his campaign staff has suggested that there would be rules denying standard credit refunds to non-workers and current non-filers. If such rules were proposed, the tax cuts for the bottom income group would be somewhat lower than our analysis shows. On the other hand, such rules would be hard to police, given the incentive the credit would create to report some earnings (even if none exist). [ii]

Overall, we found that:

- The poorest 20 percent of Americans would receive a tax cut averaging $2,168 a year (assuming full refundability of the standard credit).

- Middle-income Americans would receive an average tax cut of $2,859.

- The best-off one percent of taxpayers would enjoy an average tax cut of $223,783.

- More than a third of the tax cuts (34 percent) would go to the top one percent.

How the Rubio Plan Would Cut Personal Income Taxes:

- Reduces the top personal income tax rate from 39.6 percent to 35 percent, and reduces the number of tax brackets from 7 to 3 (35, 25 and 15 percent).

- Eliminates taxes on capital gains and dividends, including the 3.8 percent high-income surtax on investment income that was enacted as part of President Barack Obama’s health care reforms.

- Reduces the top tax rate on individual business income to 25 percent.

- Replaces standard deduction with a $2,000 per taxpayer (i.e., $4,000 for married couples) refundable tax credit, which phase out between $150,000 and $200,000 for individuals and between $300,000 and $400,000 for couples.

- Creates a new, partially refundable child tax credit of up to $2,500 per child on top of the existing $1,000 per-child credit. The new credit is refundable based on rules similar to the current child credit. It phase out at much higher income levels than the current child credit (starting at $150,000 for individuals and $300,000 for couples)

- Eliminates the Alternative Minimum Tax, which was designed to ensure that the wealthiest Americans pay at least a minimal amount of tax.

- Eliminates the estate tax.

As a modest offset, the plan eliminates all itemized deductions with the exception of the charitable contributions and the mortgage interest deductions, which would now be available to all taxpayers. This change would more than double the number of taxpayers who would itemize their deductions.

How the Rubio Plan Would Cut Corporate Income Taxes:

- Cuts the corporate tax rate from 35 percent to 25 percent.

- Allows for full expensing on new investments, including buildings and land.

- Enacts a territorial tax system.

The plan also includes some revenue offsets:

- Eliminates the deductibility of interest expense (except for financial businesses).

“By eliminating personal taxes on capital gains and other investment income, repealing the estate tax and cutting the corporate income tax by about half, Rubio’s plan hugely favors the wealthy,” said CTJ Director Bob McIntyre. “And by reducing revenues by almost $12 trillion over a decade, his plan will require draconian cuts to essential public services and likely wreck our economy.”

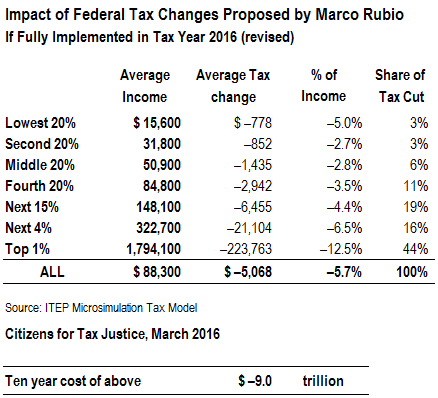

Addendum: Modeling Rubio’s Plan Under Alternative Assumptions

In the table below we adjusted the estimated size of Rubio’s tax cuts downward from our previous estimate, based on new information that his advertised “refundable” standard credit would not be nearly as refundable as he has publicly claimed, and that the new credit would replace not only the standard deduction but also taxpayer personal exemptions (but not dependents’ exemptions).

[i] “A Pro-Growth, Pro-Family Tax Plan for the New American Century” https://marcorubio.com/issues-2/rubio-tax-plan/

[ii] The Rubio campaign is quoted as saying “Rules would be tailored to ensure that our reforms would not create payments for new, non-working filers.” Dylan Matthews, “Marco Rubio and John Harwood’s testy debate exchange on taxes, explained.” October 30, 2015. http://www.vox.com/2015/10/30/9642850/marco-rubio-john-harwood