April 9, 2015 12:49 PM | Permalink | ![]()

Companies From Various Sectors Use Legal Tax Dodges to Avoid Taxes

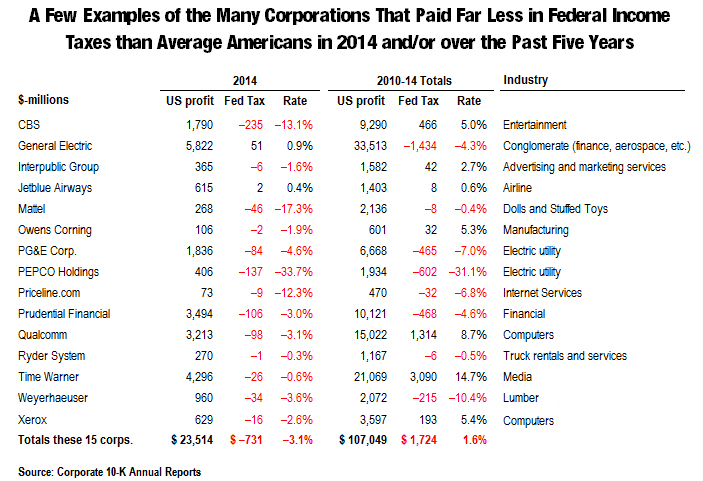

This CTJ report illustrates how profitable Fortune 500 companies in a range of sectors of the U.S. economy have been remarkably successful in manipulating the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. These 15 corporations’ tax situations shed light on the widespread nature of corporate tax avoidance. As a group, the 15 companies paid no federal income tax on $23 billion in profits in 2014, and they paid almost no federal income tax on $107 billion in profits over the past five years. All but two received federal tax rebates in 2014, and almost all paid exceedingly low rates over five years.

Companies Represent Diverse Economic Sectors

The companies profiled here represent a range of segments of the U.S. economy:

- Broadcaster CBS Corporation enjoyed $1.8 billion in U.S. profits last year, and received a federal income tax rebate of $235 million.

- Doll-maker Mattel, which has paid zero federal income taxes over the past five years, received a tax rebate of $46 million in 2014.

- The financial services corporation Prudential avoided all federal income taxes on its $3.5 billion in U.S. profits in 2014.

- Ryder System, which provides truck rentals and services, paid a negative 0.3 percent federal income tax rate in 2014 and over the past five years a negative 0.5 percent rate.

- California-based utility PG&E had negative tax rates both in 2014 and over the five-year period.

All 15 companies’ effective federal income tax rates for 2014 and the five-year period between 2010 and 2014 are shown in the table below:

Companies’ Low Taxes Stem from a Variety of Legal Tax Breaks

While recent policy discourse has focused on multinational corporations that use offshore tax havens to minimize their tax liability, the companies profiled here appear to be using a diverse array of other tax breaks to zero out their federal income taxes:[i]

Jetblue, PG&E, PEPCO Holdings and Ryder used accelerated depreciation, a tax break that allows companies to write off the cost of their capital investments much faster than these investments wear out, to dramatically reduce their tax rates. CTJ has estimated that closing the accelerated depreciation loophole could raise more than $428 billion over the next decade.[ii] Both Congress and President Barack Obama, however, have supported expanding the scope of this tax break in recent years.

Priceline relied heavily on a single tax break — writing off the value of executive stock options for tax purposes — to zero out its tax liability not just in 2014 but in 2013, 2012 and 2011 as well. In addition, the company admits that this tax break could offset all taxes on up to $1.2 billion in profits going forward. Mattel also reports enjoying $140 million in stock option tax breaks over the past five years. Former U.S. Senator Carl Levin (D-MI) has estimated that this tax break will costs $23 billion over the next decade.[iii]

Qualcomm has enjoyed more than $290 million in research and development tax breaks over the past three years. The R&E tax credit has been criticized for rewarding companies for “research” they would have done anyway, as well as rewarding research in areas such as fast-food packaging.[iv]

General Electric uses the “active financing” tax break as one of many ways that it eliminates its U.S. income tax bill.[v] This arcane tax break allows some multinational financial institutions to avoid paying income taxes to any government on their international financing activities. The Joint Committee on Taxation estimates the current ten-year cost of this provision to be $70.2 billion.[vi]

Corporate Tax Reform Should Repeal Tax Loopholes and Restore Overall Corporate Tax Revenues to a More Reasonable Level

In recent years, the public’s attention has been drawn to the elaborate tax avoidance mechanisms used by a few huge corporations such as General Electric, Apple, Microsoft and others. But as this report indicates, the scope of corporate tax avoidance goes well beyond these few companies and spans a wide variety of economic sectors. Moreover, the tax breaks that have allowed these companies to be so successful in their tax avoidance are, by and large, perfectly legal, and often have been on the books for decades.

As Congress focuses on strategies for revamping the U.S. corporate income tax, a sensible starting point should be to critically assess the costs of each of these tax breaks and to take steps to ensure that profitable corporations pay their fair share of U.S. taxes.

The next step is just as important. The revenues raised from eliminating corporate tax subsidies should not be given right back to corporations in the form of tax-rate reductions, as corporate lobbyists and their allies inside the Washington Beltway preposterously argue. Instead, as the vast majority of Americans understand, these desperately needed revenues should be used to address our nation’s fiscal problems and to make critically needed public investments in our nation’s future.

[i] Accelerated depreciation and the stock options loophole, and how Congress could raise revenue by repealing them, are described in Citizens for Tax Justice, “Policy Options to Raise Revenue,” March 8, 2012. http://ctj.org/ctjreports/2012/03/policy_options_to_raise_revenue.php The “active financing exception” is described in Citizens for Tax Justice, “Don’t Renew the Offshore Tax Loopholes,” August 2, 2012. http://ctj.org/ctjreports/2012/08/dont_renew_the_offshore_tax_loopholes.php

[ii] Citizens for Tax Justice, “Addressing the Need for More Federal Revenue,” July 8, 2014.https://ctj.sfo2.digitaloceanspaces.com/pdf/policyoptions2014.pdf

[iii] Ibid.

[iv] Citizens for Tax Justice, “Reform the Research Tax Credit — Or Let It Die,” December 4, 2013. http://ctj.org/ctjreports/2013/12/reform_the_research_tax_credit_–_or_let_it_die.php

[v] As the New York Times documented, the director of GE’s tax department literally “dropped to his knee” when begging House Ways and Means Committee staff to extend the active financing tax break when it was set to expire in 2008. http://www.nytimes.com/2011/03/25/business/economy/25tax.html

[vi] Joint Committee on Taxation, “Estimated Budget Effects Of The Revenue Provisions Contained In The President’s Fiscal Year 2016 Budget Proposal,” March 06, 2015.