April 7, 2016 12:21 PM | Permalink | ![]()

Corporate income taxes in the United States as a share of the economy are significantly less than the average among developed nations, according to an analysis of the most recent data from the Organization for Economic Cooperation and Development (OECD). Data from the Treasury Department show that U.S. corporate taxes as a percentage of GDP are 2.3 percent, which is 15 percent less than the 2.7 percent weighted average among the other 32 OECD countries for which data are available. [1]U.S. corporate income taxes have declined sharply as a percentage of GDP since 1945. [2] Part of the reason corporations are paying less in taxes today than they did 70 years ago is due to copious changes in the tax code. Yet there is a growing and vocal movement among well-financed lobbying groups to push federal lawmakers to lower the corporate tax rate. These business-backed groups claim that the U.S. corporate tax rate is too high, citing the 35 percent federal statutory tax rate. But that narrow argument ignores critical facts such as the many large tax breaks, loopholes and other corporate tax exceptions that big businesses have successfully lobbied to embed in the tax code. A 2014 study by Citizens for Tax Justice examined five years of data and found that Fortune 500 companies paid an average federal effective corporate income tax rate of only 19.4 percent, which is just over half of the nominal U.S. statutory rate of 35 percent. That same study found that many profitable, large U.S. corporations such as Boeing, General Electric and Verizon paid no federal corporate income taxes at all. [3]Rather than cutting the rate as many lawmakers are proposing, a better approach to corporate tax reform would be to eliminate the tax breaks and loopholes that allow many companies to get away with not paying their fair share. This approach would not only make the tax system more fair, but it would also help ensure that we have enough resources for critical investments in infrastructure, transportation, education, health, public and food safety, all of which benefit the public and corporations alike. [1] OECD continues to use Bureau of Economic Analysis (BEA) estimates of corporate tax payments, while we use actual collections as reported by the U.S. Treasury in its “Monthly Treasury Statements” of federal tax collections and by the U.S. Census Bureau for state & local corporate income taxes (“U.S. Census Bureau, Quarterly Summary of State and Local Government Tax Revenue, Table 1. National totals of state and local government tax revenue, by type of tax”). Previously, OECD’s approach hugely overstated US corporate taxes for several reasons. OECD has corrected most of its errors, but not all. The biggest remaining difference between OECD’s figures and actual U.S. corporate tax collections is that OECD appears to include “Taxes paid by domestic corporations to foreign governments on income earned abroad” as corporate taxes paid to US governments.[2] Office of Management and Budget, “The Budget for Fiscal Year 2017, Historical Tables,” Table 2.3, https://www.whitehouse.gov/sites/default/files/omb/budget/fy2017/assets/hist.pdf [3] Citizens for Tax Justice, “The Sorry State of Corporate Taxes,” February 2014. http://www.ctj.org/corporatetaxdodgers/

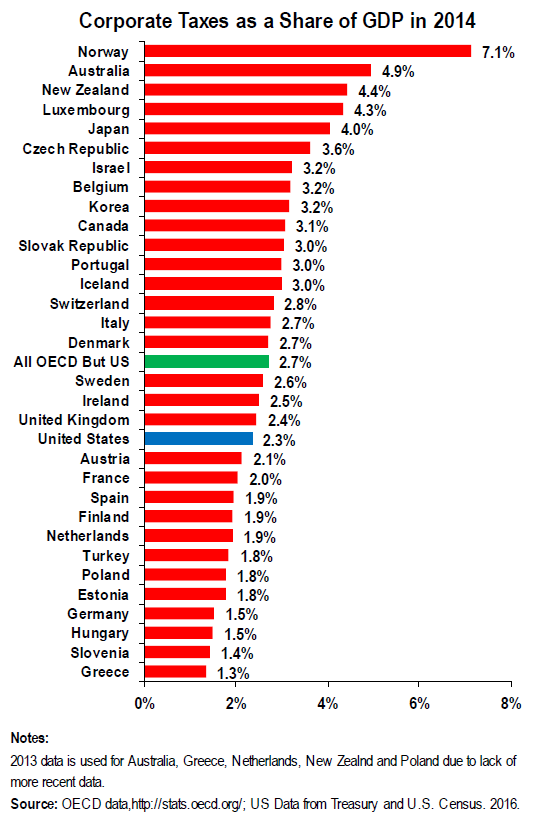

Corporate income taxes in the United States as a share of the economy are significantly less than the average among developed nations, according to an analysis of the most recent data from the Organization for Economic Cooperation and Development (OECD). Data from the Treasury Department show that U.S. corporate taxes as a percentage of GDP are 2.3 percent, which is 15 percent less than the 2.7 percent weighted average among the other 32 OECD countries for which data are available. [1]

U.S. corporate income taxes have declined sharply as a percentage of GDP since 1945. [2] Part of the reason corporations are paying less in taxes today than they did 70 years ago is due to copious changes in the tax code. Yet there is a growing and vocal movement among well-financed lobbying groups to push federal lawmakers to lower the corporate tax rate. These business-backed groups claim that the U.S. corporate tax rate is too high, citing the 35 percent federal statutory tax rate. But that narrow argument ignores critical facts such as the many large tax breaks, loopholes and other corporate tax exceptions that big businesses have successfully lobbied to embed in the tax code. A 2014 study by Citizens for Tax Justice examined five years of data and found that Fortune 500 companies paid an average federal effective corporate income tax rate of only 19.4 percent, which is just over half of the nominal U.S. statutory rate of 35 percent. That same study found that many profitable, large U.S. corporations such as Boeing, General Electric and Verizon paid no federal corporate income taxes at all. [3]

Rather than cutting the rate as many lawmakers are proposing, a better approach to corporate tax reform would be to eliminate the tax breaks and loopholes that allow many companies to get away with not paying their fair share. This approach would not only make the tax system more fair, but it would also help ensure that we have enough resources for critical investments in infrastructure, transportation, education, health, public and food safety, all of which benefit the public and corporations alike.

[1] OECD continues to use Bureau of Economic Analysis (BEA) estimates of corporate tax payments, while we use actual collections as reported by the U.S. Treasury in its “Monthly Treasury Statements” of federal tax collections and by the U.S. Census Bureau for state & local corporate income taxes (“U.S. Census Bureau, Quarterly Summary of State and Local Government Tax Revenue, Table 1. National totals of state and local government tax revenue, by type of tax”). Previously, OECD’s approach hugely overstated US corporate taxes for several reasons. OECD has corrected most of its errors, but not all. The biggest remaining difference between OECD’s figures and actual U.S. corporate tax collections is that OECD appears to include “Taxes paid by domestic corporations to foreign governments on income earned abroad” as corporate taxes paid to US governments.

[2] Office of Management and Budget, “The Budget for Fiscal Year 2017, Historical Tables,” Table 2.3, https://www.whitehouse.gov/sites/default/files/omb/budget/fy2017/assets/hist.pdf

[3] Citizens for Tax Justice, “The Sorry State of Corporate Taxes,” February 2014. http://www.ctj.org/corporatetaxdodgers/