September 16, 2015 11:14 AM | Permalink | ![]()

Two of the most significant programs helping families living in poverty are provided through the tax code – the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). Together, these two tax credits (excluding the non-refundable part of the CTC) lifted 9.8 million people out of poverty, including 5.2 million children, in 2014.[i] In fact, the EITC and CTC lift more people out of poverty than any other federal program aside from Social Security.

Poverty data released by the Census Bureau in September 2015 show that the national poverty rate remained at 14.8%, which is 18 percent higher than it was before the economic recession and 33 higher than its historic low in 1973. In a 2012 cross-country comparison of 31 OECD countries, the United States had the third highest poverty rate among developed nations. Only Israel and Mexico had higher poverty rates. All of these facts make a strong case for strengthening and preserving programs that help lift people out of poverty. The EITC and CTC are proven strategies for rewarding work, putting more money back in the pockets of hardworking people and lifting families and children out of poverty.

A significant portion of the benefits that families currently receive through the EITC and CTC is the result of improvements enacted in 2009 as part of the American Recovery and Reinvestment Act (ARRA). Unfortunately, these provisions are set to expire after 2017. Congress should act to make the expiring EITC and CTC provisions permanent, and it should further strengthen the program by expanding the EITC to reduce poverty among households without children.

EITC and CTC Basics and ARRA Provisions

The EITC is a refundable tax credit targeted to lower-income households equal to a percentage of earnings up to a certain amount. The credit percentage, maximum credit amount, and eligible income range vary according to household composition. For example, in 2015 a single parent with two children could receive a 40 percent credit up to a maximum of $5,548. After this family’s income reaches $18,110, the credit begins to phase out until it is reduced to zero at incomes above $44,454. The ARRA expanded the credit by allowing families with three or more children to receive a 45 percent rather than 40 percent credit and it also reduced “marriage penalties” by increasing the income threshold at which the credit begins phasing out for married couples.

The CTC, which is meant to help families offset the cost of raising children, is a credit of up to $1,000 per child. Families that have a tax liability lower than the amount of credit they are eligible to receive can claim the Additional Child Tax Credit, which allows them to receive a refund equal to 15 percent of their earnings above $3,000, up to the maximum $1,000-per-child credit amount. If the ARRA improvements are allowed to expire in 2017, this $3,000 income threshold will revert back to the higher threshold in the permanent law. This would mean that millions of the lowest-income families who most need assistance would no longer be able to receive the refundable portion of the credit. For instance, a parent working full-time at the federal minimum wage of $7.25 would lose her entire credit in 2018.[ii]

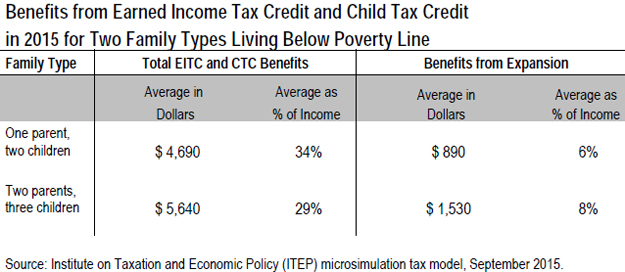

The table below shows the average EITC and CTC benefits received by two different types of families living under the poverty line: a single-parent family with two children and a two-parent family with three children. A significant amount of these benefits are related to the improvements made to the credits in 2009 and would be lost if these provisions are allowed to expire.

|

|

|

|

|

If Congress allows the ARRA improvements to these two credits to expire, over 13 million families, including nearly 25 million children, would be adversely impacted, losing an average of $1,073 in 2018.[iii]

Benefits Associated with Working Family Tax Credits

The EITC and the CTC have many more benefits than lifting families out of poverty. Studies have demonstrated that the EITC increases workforce participation, especially among single mothers. [iv] Other research has found these tax credits for working families are associated with improved health among mothers and infants, as well as improved academic achievement, higher graduation rates, and higher college attendance rates among children. Some studies also suggest that children in families receiving these credits work more and have higher earnings in adulthood.

In addition to the benefits to recipients, the EITC and CTC are also beneficial for communities since lower-income people need and use these financial resources and, as a result, pump money back into local economies. Economic studies have suggested that each dollar of EITC received in a community generates more than a dollar (local estimates range from $1.07 to $1.67 per dollar received) in local economic activity.[v]

Congress Must Prioritize the EITC and CTC

Congress has yet to take any action on making critical ARRA provisions permanent, even though their expiration would harm millions of working families. Yet lawmakers continue to actively debate deficit-financed business tax cuts known as tax extenders. The House of Representatives has so far this year passed bills making several tax extenders permanent that would add more than $300 billion to the deficit over the next decade.[vi] Members of Congress continue to insist that the cost of permanently extending the expiring provisions of the EITC and CTC must be offset with spending cuts, but they make no such demands for tax breaks for businesses. As a result of this double standard, those families that most need assistance stand to lose the most. Congress must put working families first and make permanent the ARRA’s tax credits for working families.

Expanding the Reach of the EITC

While the EITC and CTC are enormously successful in bringing families with children above the poverty line, the EITC could be improved to reduce poverty rates among childless adults and non-custodial parents. Currently, the latter are the only group of workers that is taxed into poverty or deeper into poverty by the federal income tax system.[vii] Workers without children and non-custodial parents are only eligible for a small fraction of the credit that families with children can receive. The maximum credit in 2015 for childless workers is just $503, while families with one child can receive a maximum of $3,359. Additionally, individuals without children must be at least 25 years old to claim the credit, so vulnerable young people trying to get a foothold in the workforce are excluded from the work-promoting and poverty-reducing benefits of the EITC.

Expanding the EITC for childless workers has received bipartisan support, with similar proposals made by Democratic lawmakers in the Senate and the House, the Obama Administration, and House Ways and Means Committee Chairman Paul Ryan (R-WI). A previous CTJ analysis found that increasing the maximum credit from $503 to $1,400 and lowering the age threshold from 25 to 21 would help more than 10.6 million people, with an average benefit of $604.[viii]

Unlike other federal anti-poverty programs, the EITC and CTC have always enjoyed bipartisan support. Given their proven ability to reduce poverty, increase workforce participation, and improve children’s health, academic, and future economic outcomes, these tax credits should be preserved and strengthened. Congress should save the expiring provisions of the EITC and CTC that benefit so many working families struggling to make ends meet. And lawmakers should also go one step further and fix a glaring gap in the EITC by expanding the credit for childless workers and non-custodial parents to make a larger dent in poverty across the nation.

[i] Census Bureau, “The Supplemental Poverty Measure: 2014,” September 2015 http://www.census.gov/content/dam/Census/library/publications/2015/demo/p60-254.pdf

[ii] Ibid.

[iii] Citizens for Tax Justice, “Making the EITC and CTC Expansions Permanent Would Benefit 13 Million Working Families,” February 20, 2015. http://ctj.org/ctjreports/2015/02/making_the_eitc_and_ctc_expansions_permanent_would_benefit_13_million_working_families.php#.Vd47Fn13cng

[iv] Chuck Marr, Chye-Ching Huang, Arloc Sherman, and Brandon DeBot, “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds,” April 3, 2015. http://www.cbpp.org/research/federal-tax/eitc-and-child-tax-credit-promote-work-reduce-poverty-and-support-childrens

[v] National Community Tax Coalition, “The Earned Income Tax Credit: Good for Our Families, Community and Economy,” January 2012. http://www.taxcreditsforworkingfamilies.org/wp-content/uploads/2012/01/NCTC-EITC-paper_Jan2012.pdf

[vi] Bernie Becker and Cristina Marcos, “House passes research and development tax credit,” The Hill, May 20, 2015. http://thehill.com/blogs/floor-action/house/242756-house-passes-research-and-development-tax-credit; Chuck Marr and Brandon DeBot, “House Efforts to Make Tax “Extenders” Permanent Are Ill-Advised,” Center on Budget and Policy Priorities, May 19, 2015. http://www.cbpp.org/research/federal-tax/house-efforts-to-make-tax-extenders-permanent-are-ill-advised

[vii] Chuck Marr and Chye-Ching Huang, “Strengthening the EITC for Childless Workers Would Promote Work and Reduce Poverty,” Center on Budget and Policy Priorities, February 19, 2015. http://www.cbpp.org/research/strengthening-the-eitc-for-childless-workers-would-promote-work-and-reduce-poverty?fa=view&id=3991

[viii] Citizens for Tax Justice, “Proposed Expansion of EITC to Childless Workers Would Benefit 10.6 Million Individuals and Families,” March 4, 2015. http://ctj.org/ctjreports/2015/03/proposed_senate_expansion_of_eitc_to_childless_workers_would_benefit_106_million_individuals_and_fam.php#.Vd833X13cng