March 22, 2012 03:42 PM | Permalink | ![]()

House Budget Committee Chairman Paul Ryan has introduced a budget plan that, if implemented, would reduce revenues so significantly that they would be inadequate to pay for the federal spending under the Reagan administration, let alone the spending required in the years ahead. The Ryan budget would provide income tax cuts for millionaires averaging at least $187,000 in 2014. The plan would also reduce corporate income taxes and would increase the (already considerable) incentives for corporations to shift profits and jobs overseas. Each of these three problems is described in detail below.

Tax Revenue Would Not Be Enough to Pay for Reagan-Era Spending

First, the Ryan budget would lock in the low revenue levels that are the result of the Bush tax cuts, which will expire at the end of this year if Congress simply does nothing.

The Ryan budget plan indicates that this level of revenue would equal 18 or 19 percent of GDP (that is, 18 or 19 percent of our overall economy) in the following decades. Federal spending has been greater than this for most of the past 50 years.

In fact, even during the Reagan administration, federal spending ranged from 21.3 percent to 23.5 percent of GDP. And that was at a time when America was not fighting any wars, the baby-boomers were not retiring, and health care costs had not yet skyrocketed the way they have today.[1]

Millionaires Would Receive Average Income Tax Cut of at Least $187,000 in 2014

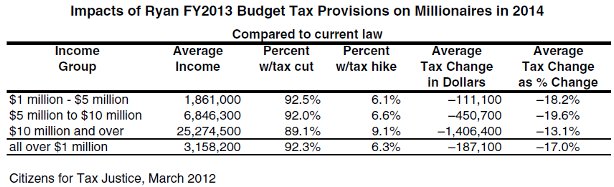

Second, the Ryan budget would replace the existing personal income tax with a personal income tax that has just two rates, 10 percent and 25 percent, repeal the Alternative Minimum Tax (AMT), and offset the costs by closing unspecified tax loopholes and tax expenditures. The table on the first page illustrates that taxpayers with adjusted gross income (AGI) exceeding $1 million would enjoy a tax cut of at least $187,000 under this plan no matter how it is implemented.

The figures in the table were calculated under the assumption that taxpayers with AGI exceeding $1 million would have to give up all the major tax loopholes and tax expenditures that Rep. Ryan could conceivably target for repeal. While Rep. Ryan does not specify which tax provisions he would repeal, these calculations assume he would repeal all itemized deductions, all tax credits, the exclusion for employer-provided health insurance, and the deduction for health insurance for the self-employed.[2]

Even under these assumptions, over 92 percent of these very high-income taxpayers would enjoy a net tax cut, and the average income tax change for these taxpayers would be a reduction of $187,000 in 2014.

The reason is that reducing the top personal income tax rate (which will be 39.6 percent in 2014 under current law) to 25 percent would provide a benefit to millionaires that would far exceed their loss of any deductions, credits, or breaks for health care.

By way of comparison, millionaires would receive an average income tax cut of $115,000 in 2014 if the Bush tax cuts are extended through that year.[3]

The Ryan budget document calls for closing enough tax loopholes and tax expenditures to ensure that this simplified personal income tax would collect as much revenue as the current system would collect if the Bush tax cuts were made permanent for everyone. This is a very low revenue goal, but Rep. Ryan’s tax proposals would almost certainly fail to meet it nonetheless.

Budget Plan Would Slash Corporate Taxes and Exempt Profits Shifted Overseas

Third, the Ryan budget would replace the statutory corporate income tax rate of 35 percent — which Rep. Ryan criticizes as one of the world’s highest — with a statutory rate of just 25 percent. The budget document comes close to admitting that the effective corporate income tax rate — the percentage of profits that corporations actually pay after accounting for the loopholes they enjoy — is far lower than 35 percent. (CTJ recently found that the 3-year effective tax rate for consistently profitable Fortune 500 corporations averaged just 18.5 percent.)[4]

It’s unclear if the Ryan budget is intended to repeal enough corporate tax subsidies to offset the cost of reducing the statutory corporate tax rate from 35 percent to 25 percent, but the non-partisan Joint Committee on Taxation (JCT) has already concluded that this is impossible in any case.

Last year, House Ways and Means Committee Chairman Dave Camp (who Ryan cites as involved in his budget overhaul effort) proposed to reduce the statutory corporate income tax rate to 25 percent and offset the costs by repealing tax subsidies. Around the same time, the Joint Committee on Taxation (JCT) concluded that repealing all corporate tax subsidies would raise enough revenue to offset the cost of reducing the corporate income tax rate to 28 percent, and no lower, for a decade. Beyond the first decade, repealing all corporate tax subsidies would raise even less revenue, meaning the corporate income tax rate would have to be higher than 28 percent to be part of any revenue-neutral corporate tax reform.[5]

Another idea that Ryan’s budget borrows from Camp’s proposal is the introduction of a “territorial” tax system, which is a euphemism for exempting the offshore profits of U.S. corporations from the corporate income tax.

A territorial system would increase the existing incentives for U.S. corporations to move their operations offshore or use accounting gimmicks to make their U.S. profits appear to be “foreign” profits generated in offshore tax havens.[6]

The tax system already encourages corporations to engage in these abuses because it allows them to “defer” (delay) paying U.S. corporate income taxes on any profits that are generated offshore or made to appear that they were generated offshore.

If allowing corporations to defer their U.S. taxes on offshore profits encourages these abuses, then exempting those offshore profits from U.S. taxes entirely would logically increase this incentive.

The only way to prevent these abuses is for Congress to enact a tax reform that repeals “deferral.” This would mean that U.S. corporations would not pay lower taxes on profits that they generate (or appear to generate) in countries with lower corporate income taxes than the U.S. And, just as in the current system, U.S. corporations would be allowed a credit for taxes paid to foreign governments, to prevent double-taxation.[7]

Why the Ryan Budget Plan Does Not Specify How It Would Pay for Tax Rate Reductions

As explained already, the Ryan budget plan calls for closing tax loopholes and tax subsidies to offset the costs of reducing tax rates (beyond the rate reductions that are part of the Bush tax cuts) but does not name any particular tax loophole or tax subsidy to be repealed.

There may be a very specific reason for this vagueness. Two years ago, when Rep. Ryan offered a budget plan that would allow individuals to pay income taxes at a top rate of 25 percent and repeal the corporate income tax, he did propose a specific way to offset the costs — a regressive value-added tax (VAT).

Citizens for Tax Justice analyzed the tax components of that plan and found that, on average, taxpayers among the richest ten percent would pay less in taxes while taxpayers among the bottom 90 percent would pay more. We also found that the plan would reduce revenues by $2 trillion over ten years.[8]

The truth is that it is very difficult to lower the top income tax rate to 25 percent and offset the costs simply by eliminating or reducing tax expenditures. That’s why Ryan’s previous plan relied on a regressive VAT. Rep. Ryan probably (correctly) decided the budget plans he would present last year and this year would seem more appealing if he left that detail out of it.

[1] Office of Management and Budget, Historical Tables, Table 1.2. http://www.whitehouse.gov/omb/budget/Historicals/

[2] Other major tax expenditures are supposedly incentives for savings and investments and would surely not be repealed because the Ryan budget plan specifically objects to “raising taxes on investing.” For example, the preferential rates for capital gains and stock dividends and various breaks for retirement savings are clearly not among those tax expenditures Ryan would repeal, given that language in the budget document.

[3] These figures refer to federal personal income taxes. Millionaires would receive other types of tax cuts under the Ryan budget plan. For example, the plan does not specify what would be done with the federal estate tax, but it strongly implies that it would not allow the estate tax cut in effect this year to expire. The Ryan budget plan would also repeal a reform of the Medicare tax (which was included in President Obama’s health care reform) that increases the Medicare tax from 2.9 percent to 3.8 percent for wages of high-income individuals and applies the 3.8 percent Medicare tax to investment income as well.

[4] Citizens for Tax Justice, “Corporate Taxpayers & Corporate Tax Dodgers, 2008-2010,” November 3, 2011. http://ctj.org/corporatetaxdodgers

[5] Letter from Thomas A. Barthold, Joint Committee on Taxation, October 27, 2011. http://democrats.waysandmeans.house.gov/media/pdf/112/JCTRevenueestimatesFinal.pdf

[6] A CTJ fact sheet explains why Congress should reject any proposal to exempt offshore corporate profits from U.S. taxes. Citizens for Tax Justice, “Why Congress Should Reject A ‘Territorial’ System and a ‘Repatriation’ Amnesty: Both Proposals Would Remove Taxes on Corporations’ Offshore Profits,” October 19, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporateinternationalfactsheet.pdf

[7] For more, see Citizens for Tax Justice, “Congress Should End ‘Deferral’ Rather than Adopt a ‘Territorial’ Tax System,” March 23, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/internationalcorptax2011.pdf

[8] Citizens for Tax Justice, “Rep. Ryan’s House GOP Budget Plan: Federal Government Would Collect $2 Trillion Less Over a Decade and Yet Require Bottom 90 Percent to Pay Higher Taxes,” March 9, 2010. https://ctj.sfo2.digitaloceanspaces.com/pdf/ryanplan2010.pdf