July 13, 2012 12:08 PM | Permalink | ![]()

Revised July 16, 2012

Read the PDF of this fact sheet.

“So I’m not proposing anything radical here. I just believe that anybody making over $250,000 a year should go back to the income tax rates we were paying under Bill Clinton…”

President Barack Obama, July 9, 2012

There are a few things that President Obama has not explained well about his proposal to extend most, but not all, of the Bush income tax cuts for one year.

1. President Obama’s proposal would allow everyone — even billionaires — to continue enjoying the lower Bush-era income tax rates on the first $250,000 they make (or the first $200,000 in the case of unmarried taxpayers). And that’s $250,000 or $200,000 in 2009 dollars (apparently because 2009 was when the President first formally made this proposal).1

So, in 2013, a married couple would actually continue to pay the lower tax rates on at least the first $264,850 they make, and a single taxpayer would continue to pay the lower tax rates on at least the first $211,800 he or she makes. We say “at least” because the thresholds assume that these taxpayers all take the standard deduction, even though the vast majority of them have much bigger deductions because they itemize. On average, the actual threshold for married couples in 2013 will be more than $300,000.2

2. It’s essential to understand that a married couple making more than the threshold would not “go back to paying the income tax rates we were paying under Bill Clinton,” except on the amount of income above the threshold. So a couple with, say, $100 in income above the threshold would pay a higher tax rate only on the $100. The higher tax for this couple would be 3 percent of the $100 — a mere $3.00.

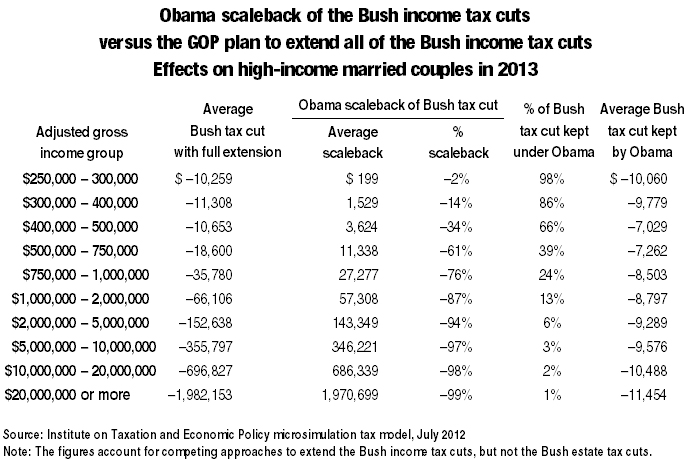

3. For all these reasons, couples with adjusted gross income (AGI) between $250,000 and $300,000 would retain 98% of their Bush income tax cuts, on average, under Obama’s proposal.

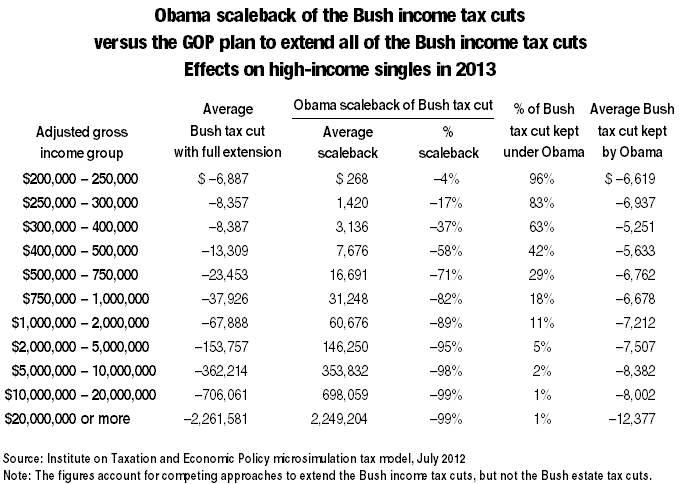

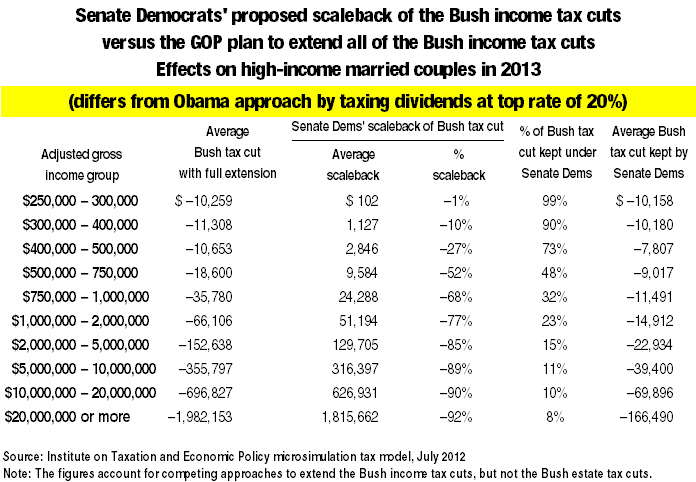

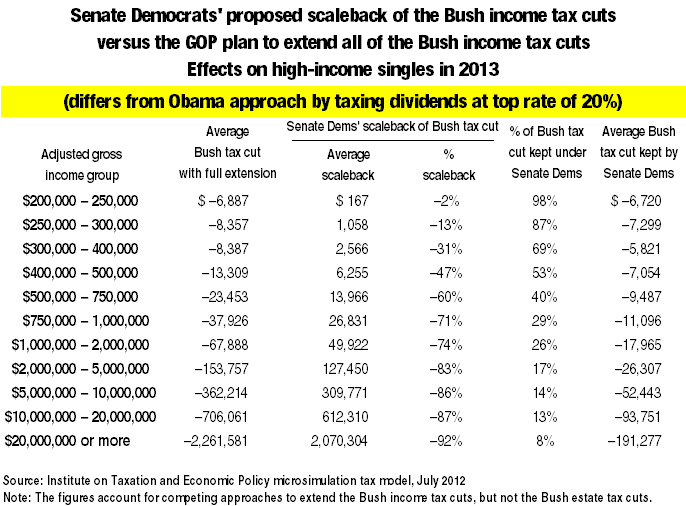

The following tables show how much of the Bush income tax cuts would typically be lost by upper-income couples and singles under Obama’s plan versus the GOP plan to extend all of the Bush income tax cuts. These figures were revised to demonstrate the impacts of President Obama’s approach and also the approach considered by Senate Democrats. The Senate Democrats’ approach differs in that it would extend larger tax breaks for high-income taxpayers with stock dividends (by taxing dividends at a top rate of 20 percent instead of taxing them at ordinary rates as President Obama proposes).

1Department of the Treasury, General Explanations of the Administration’s Fiscal Year 2013 Revenue Proposals, February 2012, page 70.

2Under Obama’s proposal, the top two income tax rates would revert to their pre-Bush levels. For a married couple under Obama’s proposal in 2013, taxable income would have to exceed $245,050 in order to be affected by one or both of the top two income tax brackets. A married couple with AGI of $264,850 will have taxable income of $245,050 if they take the standard deduction ($12,100) and have no children (and therefore take only two $3,850 personal exemptions). But couples making, say, $250,000 to $300,000 typically have itemized deductions of about $50,000 and 1 child (and thus 3 personal exemptions, worth $11,550). So with more than $60,000 in deductions ane exemptions, a couple making more than $300,000 would still have taxable income below Obama’s $245,050 taxable-income threshold. As a result, 70 percent of all couples in the $250,000 to $300,000 income range in 2013 would retain all of their Bush income-tax-rate cuts.