June 30, 2016 10:21 AM | Permalink | ![]()

Background

Offshore profit shifting by U.S. multinational corporations is estimated to cost the federal government at least $111 billion annually in foregone corporate tax revenue.[1] In March, CTJ reported that Fortune 500 companies are holding $2.4 trillion offshore as “permanently invested” profits.[2] By shifting U.S. profits to foreign subsidiaries and declaring them to be permanently reinvested, corporations can avoid paying U.S. taxes on these earnings indefinitely. A key part of this tax avoidance strategy is shifting profits into subsidiaries in tax haven jurisdictions (countries or territories that have low or zero tax rates, such as Bermuda, the Cayman Islands, and Luxembourg) to minimize or even zero out worldwide income tax liability. Recent data from the Internal Revenue Service show that U.S. corporations report that 59 percent of their foreign income is earned in ten tax havens, even though their reported income in some countries exceeds its entire Gross Domestic Product.[3] This indicates that much of this income is being earned in the United States, but through accounting maneuvers made to appear on paper as though the company earned it in tax haven countries.

The Challenge

Currently, there is no single source that allows the public to see all of a corporation’s subsidiaries and how many of them are located in tax havens. The Securities and Exchange Commission (SEC) requires publicly traded corporations to report all of their “significant” subsidiaries in their annual financial reports. In 2014, 358 Fortune 500 companies disclosed owning at least 7,622 subsidiaries in tax haven countries. [4] However, since companies are permitted to omit subsidiaries that do not meet the SEC’s definition of “significant” (comprising at least 10 percent of the company’s total assets, investments, or income), the true number of tax haven subsidiaries is likely dramatically higher than what is reported. In fact, this report finds that companies may be omitting more than 85 percent of their total and tax haven subsidiaries in their 10-K filings.

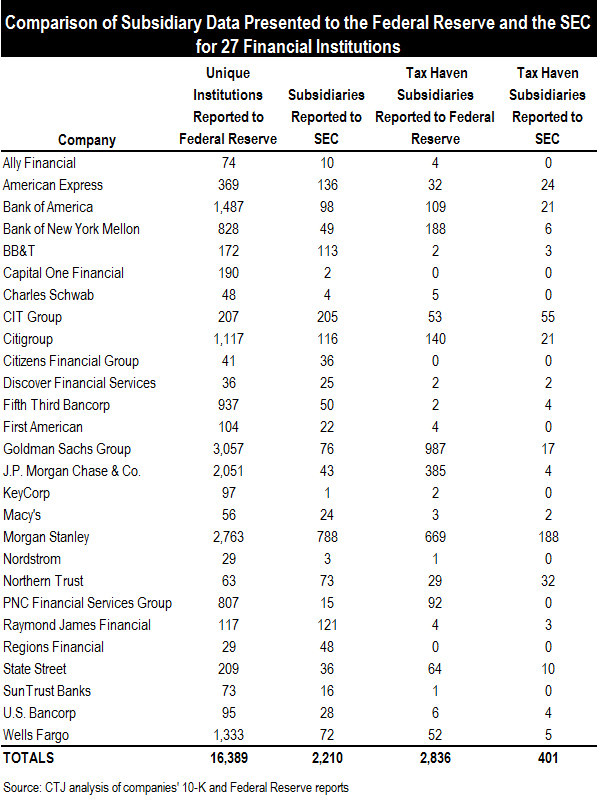

Earlier this year, OxFam America reported that there are large discrepancies between the numbers of subsidiaries reported to the SEC and to the Federal Reserve for the four largest U.S. banking institutions.[5] Following Oxfam’s methodology, CTJ finds that 27 Fortune 500 financial companies reported 2,836 tax haven subsidiaries to the Federal Reserve while only reporting 401 to the SEC. Of the total number of tax haven subsidiaries reported to the Federal Reserve, 1,145 were located in the Cayman Islands, one of the world’s most notorious tax havens.

As a group, these 27 companies are disclosing less than 15 percent of both total subsidiaries and tax haven subsidiaries to the SEC relative to what they disclose to the Federal Reserve. Even the Federal Reserve data may understate the actual number of subsidiaries (and tax haven subsidiaries) companies have, as it too allows some exclusions in its reporting requirements. While the level of disclosure varies by company, with some disclosing similar numbers to the two regulatory bodies, there are some particularly notable offenders.

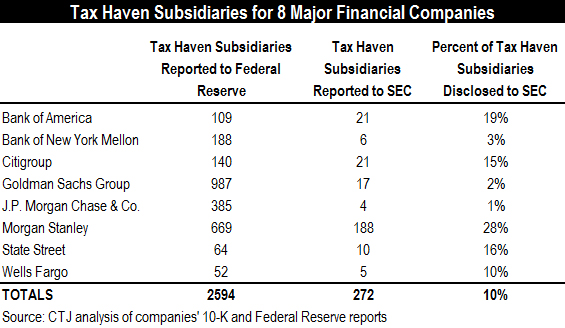

The prominent financial companies in the table above both have large numbers of subsidiaries in tax haven jurisdictions and disclose less than 30 percent of them to the SEC. It is also worth noting that these eight companies that make extensive use of tax havens benefitted from $165 billion in taxpayer-funded bailout funds during the financial crisis.[6]

While the results of our previous Offshore Shell Games study revealed the widespread use of tax haven subsidiaries by Fortune 500 companies, the Federal Reserve data reveal that the subsidiaries listed in the SEC filings are just the tip of the iceberg.

The Need for More Disclosure

It is likely that many other multinational corporations are under-disclosing tax haven subsidiaries to the SEC, but the extent of this is unclear since more complete information is not available for the hundreds of Fortune 500 corporations that are not regulated by the Federal Reserve. If, however, the pattern for the financial companies is similar for the whole Fortune 500 list, it would mean that rather having over 7,000 tax haven subsidiaries as reported to the SEC, Fortune 500 companies may have over 50,000 tax haven subsidiaries.

Accurate reporting on tax haven subsidiaries and the amount of earnings being held is vital both to investors and to policymakers. According to a recent report from Credit Suisse, numerous major companies (such as Mattel, Xerox and General Electric) may have offshore tax liabilities that constitute more than 10 percent of their total market capitalization.[7] In other words, understanding a company’s offshore tax planning is critical to getting a complete picture of the financial status of many companies.

Now is an opportune time to take action on this issue, as the SEC already has a review process on its disclosure requirements underway.[8] Additionally, it has specifically requested comments on whether it should change the definition of a “significant” subsidiary or require companies to report all subsidiaries. CTJ recommends that the SEC should require the disclosure of all subsidiaries, regardless of size, as well as their location, relationship to the parent company, and unique Legal Entity Identifier (LEI). Such disclosure would give the public and investors alike crucial insights into the offshore finances of our nation’s largest companies.

[1] Kimberly A. Clausing, “Profit shifting and U.S. corporate tax policy reform,” Washington Center for Equitable Growth, May 2016. http://equitablegrowth.org/report/profit-shifting-and-u-s-corporate-tax-policy-reform/

[2] Citizens for Tax Justice, “Fortune 500 Companies Hold a Record $2.4 Trillion Offshore,” March 4, 2016. http://ctj.org/ctjreports/2016/03/fortune_500_companies_hold_a_record_24_trillion_offshore.php#.V2mR69QrKV4.

[3] Citizens for Tax Justice, “American Corporations Tell IRS the Majority of Their Offshore Profits are in 10 Tax Havens,” April 7, 2016. http://ctj.org/ctjreports/2016/04/american_corporations_tell_irs_the_majority_of_their_offshore_profits_are_in_10_tax_havens.php#.V21NZtQrKV4

[4] Citizens for Tax Justice, “Offshore Shell Games 2015,” October 5, 2015. http://ctj.org/ctjreports/2015/10/offshore_shell_games_2015.php#mostof

[5] Oxfam America, “A hidden network of hidden wealth,” January 11, 2016. http://politicsofpoverty.oxfamamerica.org/2016/01/a-hidden-network-of-hidden-wealth/

[6] ProPublica, “Bailout Recipients,” updated June 20, 2016. https://projects.propublica.org/bailout/list

[7] Credit Suisse, “Parking A-Lot Overseas: At Least $690 Billion in Cash and Over $2 Trillion in Earnings,” March 17, 2015. https://doc.research-and-analytics.csfb.com/docView?language=ENG&format=PDF&source_id=em&document_id=1045617491&serialid=jHde13PmaivwZHRANjglDIKxoEiA4WVARdLQREk1A7g%3D

[8] Securities and Exchange Commission, “Business and Financial Disclosure Required by Regulation S-K,” Release No. 33-10064; 34-77599; File No. S7-06-16. https://www.sec.gov/rules/concept/2016/33-10064.pdf