August 21, 2013 02:27 PM | Permalink | ![]()

In recent years, the corporate tax reform debate in the nation’s capital has been invaded by an army of acronyms such as T.I.E., A.C.T. and R.A.T.E., representing diff¬erent businesses and corporate interest groups. These groups seek to rebrand and build momentum for a corporate tax reform that benefits corporate rather than public interests. In this report we identify the nine lobby groups most actively and publicly advocating for business interests in the corporate tax debate: the Alliance for Competitive Taxation (ACT), Businesses United for Interest and Loan Deductibility (BUILD), Campaign for a Home Court Advantage (a campaign by the Business Roundtable), Coalition for Fair Effective Tax Rates, Fix the Debt, Let’s Invest for Tomorrow (LIFT) America, Reforming America’s Taxes Equitably (RATE), Tax Innovation Equality, and the WIN America Campaign. We also identify the ten U.S. corporations most aggressively pursuing tax reform through these groups based on each of the company’s participation in four or more such coalitions. Though the specific goals of these groups vary, there are common threads between them. For example, five of the nine groups explicitly support moving to a territorial tax system, which would exacerbate corporate tax avoidance overseas and promote the offshoring of jobs. Four of the groups explicitly support revenue-neutral tax reform. And, the WIN America Campaign, BUILD, and TIE each support either protecting or implementing very specific tax breaks that would benefit their corporate backers. For a full inventory of the groups’ policy positions see Table 1. Based just on the lists of corporate members released by these groups (many remain private), they represent at least 359 different corporations and 186 different trade associations. Further, 87 of the corporations are actually supporters of two or more of these corporate tax lobbying efforts, with 31 supporting as many as 3 or more of these groups. See Table 2 for breakdown of the most active corporations and which groups they belong to.Not surprisingly, many of the companies behind these corporate tax reform coalitions already pay little or even nothing in corporate taxes. See Table 3 for the six corporations that back multiple lobbies for lower taxes even as they paid nothing in corporate income taxes over the 2008-2010 period. See Table 4 for the four corporations that back multiple lobbies supporting a territorial tax system and/or a repatriation holiday and have billions in offshore cash for which they have paid almost nothing so far in taxes. By their own estimates, these four companies admit that they would have to pay almost $40 billion combined in taxes if they were to bring their offshore money back to the United States.

In recent years, the corporate tax reform debate in the nation’s capital has been invaded by an army of acronyms such as T.I.E., A.C.T. and R.A.T.E., representing different businesses and corporate interest groups. These groups seek to rebrand and build momentum for a corporate tax reform that benefits corporate rather than public interests.

In this report we identify the nine lobby groups most actively and publicly advocating for business interests in the corporate tax debate: the Alliance for Competitive Taxation (ACT), Businesses United for Interest and Loan Deductibility (BUILD), Campaign for a Home Court Advantage (a campaign by the Business Roundtable), Coalition for Fair Effective Tax Rates, Fix the Debt, Let’s Invest for Tomorrow (LIFT) America, Reforming America’s Taxes Equitably (RATE), Tax Innovation Equality, and the WIN America Campaign.

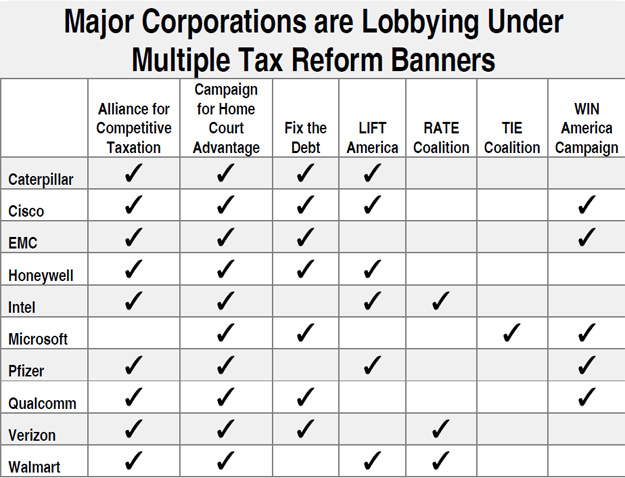

We also identify the ten U.S. corporations most aggressively pursuing tax reform through these groups based on each of the company’s participation in four or more such coalitions.

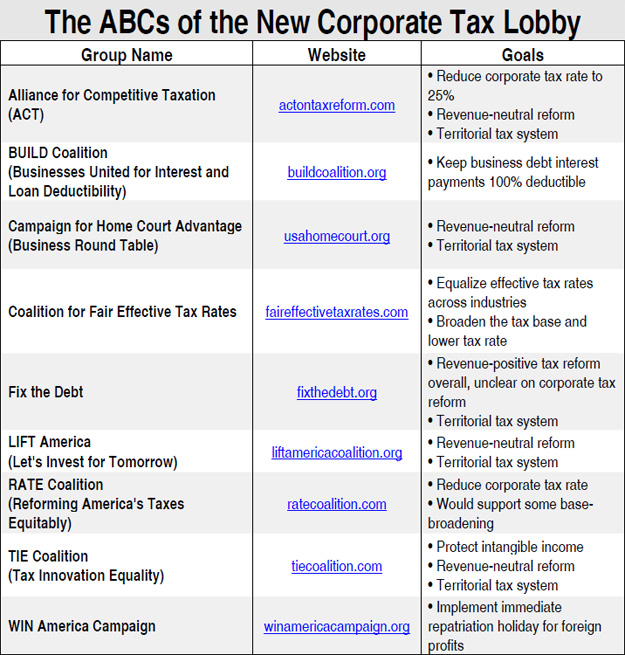

Though the specific goals of these groups vary, there are common threads between them. For example, five of the nine groups explicitly support moving to a territorial tax system (PDF), which would exacerbate corporate tax avoidance overseas and promote the offshoring of jobs. Four of the groups explicitly support revenue-neutral tax reform (PDF). And, the WIN America Campaign, BUILD, and TIE each support either protecting or implementing very specific tax breaks that would benefit their corporate backers. For a full inventory of the groups’ policy positions see Table 1.

Based just on the lists of corporate members released by these groups (many remain private), they represent at least 359 different corporations and 186 different trade associations. Further, 87 of the corporations are actually supporters of two or more of these corporate tax lobbying efforts, with 31 supporting as many as 3 or more of these groups. See Table 2 for breakdown of the most active corporations and which groups they belong to.

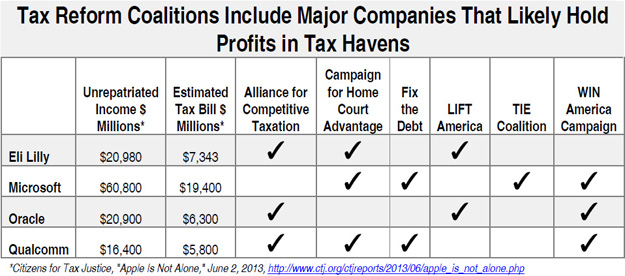

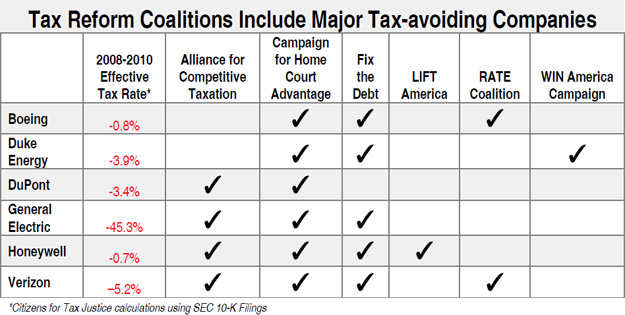

Not surprisingly, many of the companies behind these corporate tax reform coalitions already pay little or even nothing in corporate taxes. See Table 3 for the six corporations that back multiple lobbies for lower taxes even as they paid nothing in corporate income taxes over the 2008-2010 period. See Table 4 for the four corporations that back multiple lobbies supporting a territorial tax system and/or a repatriation holiday and have billions in offshore cash for which they have paid almost nothing so far in taxes. By their own estimates, these four companies admit that they would have to pay almost $40 billion combined in taxes if they were to bring their offshore money back to the United States.

Table 1

Table 2

Table 3

Table 4