November 26, 2013 02:53 PM | Permalink | ![]()

American Express’s Tax Avoidance Opposed by Most Small Businesses

Since 2010, American Express has boosted itself as a supporter of small businesses, by promoting “Small Business Saturday” as a counterpart to Black Friday. But American Express is no friend of American small business. Not only does it charge merchants high swipe fees, but it also uses and wants to expand offshore tax loopholes that most small businesses can’t use and want to close.

According to its SEC filings, American Express is holding $8.5 billion in low-tax offshore jurisdictions, including at least 22 offshore subsidiaries in 8 jurisdictions typically identified as “tax havens.” By its own estimates, American Express has avoided paying $2.6 billion in U.S. taxes by holding these profits offshore. To give some perspective, this amount is two and half times the budget of the entire Small Business Administration.[i]

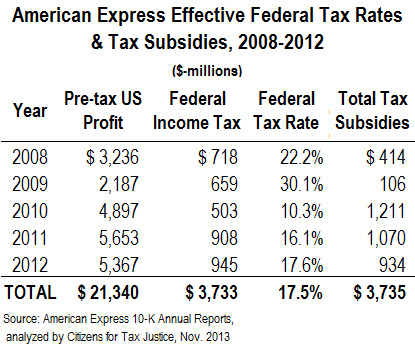

Even on the $21.3 billion in pretax profits that American Express officially earned in the U.S. over the past five years, the company has paid only half the 35 percent federal statutory tax rate. This means that over the past five years, American Express received over $3.7 billion in tax subsidies through the US tax code.

Even on the $21.3 billion in pretax profits that American Express officially earned in the U.S. over the past five years, the company has paid only half the 35 percent federal statutory tax rate. This means that over the past five years, American Express received over $3.7 billion in tax subsidies through the US tax code.

Not satisfied with its current slate of loopholes, American Express is now part of the coalition behind the Campaign for Home Court Advantage,[ii] which advocates sharply expanding offshore loopholes by moving the United States to a territorial tax system.[iii] In contrast, as many as three-quarters of small business owners believe that their small business is harmed when loopholes allow big corporations to avoid taxes.”[iv]

While American Express pretends to support small business this Saturday, remember that the company supports rigging the tax system against those same small businesses they claim to support.

[i] Office of Management and Budget, “The Budget for Fiscal Year 2014, Historical Tables”, http://www.whitehouse.gov/sites/default/files/omb/budget/fy2014/assets/hist.pdf

[ii] Citizens for Tax Justice, “Corporate-Backed Tax Lobby Groups Proliferating,” August 21, 2013. http://ctj.org/ctjreports/2013/08/corporate-backed_tax_lobby_groups_proliferating.php

[iii] Citizens for Tax Justice, “ Fact Sheet: Why Congress Should Reject A Territorial System and a Repatriation Amnesty,” October 9, 2011. http://ctj.org/ctjreports/2011/10/fact_sheet_why_congress_should_reject_a_territorial_system_and_a_repatriation_amnesty.php

[iv] The American Sustainable Business Council “Small Business Owners’ Views on Taxes and How to Level the Playing Field with Big Business,” February 6, 2012.

http://asbcouncil.org/sites/default/files/files/Taxes_Poll_Report_FINAL.pdf