October 28, 2015 02:03 PM | Permalink | ![]()

Bush’s Tax Plan Turns Populism on Its Head

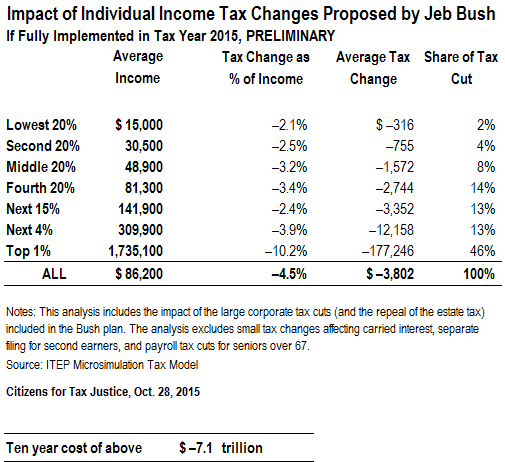

A Citizens for Tax Justice analysis of Jeb Bush’s tax plan reveals that it would cut taxes by $7.1 trillion[i] over a decade, and it would give almost half of its tax cuts to the wealthiest 1 percent of Americans.

What the Bush Plan Would Do

Bush’s tax plan includes major changes to both the personal and corporate income taxes. This analysis is an update of a previous analysis that focused only on Bush’s proposed changes to personal income taxes.[ii]

Under Bush’s plan, every income group would see a tax cut. But the plan’s tax changes would reserve the biggest benefit for the very best-off Americans. As a share of income, the top 1 percent would collectively see a tax cut equal to 10.2 percent of their income, more than two and a half times the tax changes enjoyed by any other income group, and nearly five times the size of the tax cuts that would go to the poorest 20 percent of Americans.

- The poorest 20 percent of Americans would receive a tax cut averaging $316.

- Middle-income Americans would receive an average tax cut of $1,572.

- The best-off 1 percent of taxpayers would enjoy an average tax cut of $177,246.

- Almost half of the tax cuts (46 percent) would go to the top one percent.

How the Bush Plan Would Cut Personal Income Taxes:

- Reduces the top personal income tax rate from 39.6 percent to 28 percent, and reduces the number of tax brackets from 7 to 3.

- Eliminates the 3.8 percent high-income surtax on unearned income that was enacted as part of President Barack Obama’s health care reforms.

- Eliminates the Alternative Minimum Tax, which was designed to ensure that the wealthiest Americans pay at least a minimal amount of tax.

- Cuts the maximum tax rate on interest income to 20 percent, mirroring the plan’s special treatment of capital gains and dividends.

- Increases the standard deduction by $5,000 for single filers and $10,000 for married couples.

- Doubles the size of the Earned Income Tax Credit for childless filers.

- Eliminates rules that limit the benefit of certain exemptions and deductions for high-income filers.

- Eliminates the estate tax.

The plan also includes some revenue offsets:

- Eliminates the itemized deduction for state and local income, property and sales taxes.

- Creates a new cap on the value of itemized deductions (other than charitable contributions) so that the tax benefit from these deductions cannot exceed 2 percent of a taxpayer’s Adjusted Gross Income (AGI).

- Ends the special tax break for the “carried interest” income enjoyed by hedge fund managers (although the tax rate on carried interest would be only slightly higher than now, due to Bush’s reduction in the top regular income tax rate).

How the Bush Plan Would Cut Corporate Income Taxes:

- Cuts the corporate tax rate from 35 percent to 20 percent.

- Allows for full expensing on new investments, including buildings.

- Eliminates the corporate alternative minimum tax.

- Enacts a territorial tax system with a 100 percent exemption on dividends.

The plan also includes some revenue offsets:

- Eliminates the deductibility of interest expense (except for financial businesses).

- Phases out special corporate deductions and credits, with the exception of the research and experimentation credit.

[i] Our 10-year revenue estimate differs substantially from the one offered by the Bush campaign largely due to the fact that the Bush campaign substantially underestimates the cost of its proposed corporate tax cut provisions and overestimates the amount it raises with its corporate tax offsets.

[ii] Citizens for Tax Justice, “More Than Half of Jeb Bush’s Tax Cuts Would Go To the Top 1%,” September 11, 2015. http://ctj.org/ctjreports/2015/09/jeb_bush_tax_plan_turning_populism_on_its_head.php