April 9, 2015 10:01 AM | Permalink | ![]()

All Americans pay taxes. Everyone who works pays federal payroll taxes. Everyone who buys gasoline pays federal and state gas taxes. Everyone who owns or rents a home directly or indirectly pays property taxes. Anyone who shops pays sales taxes in most states.

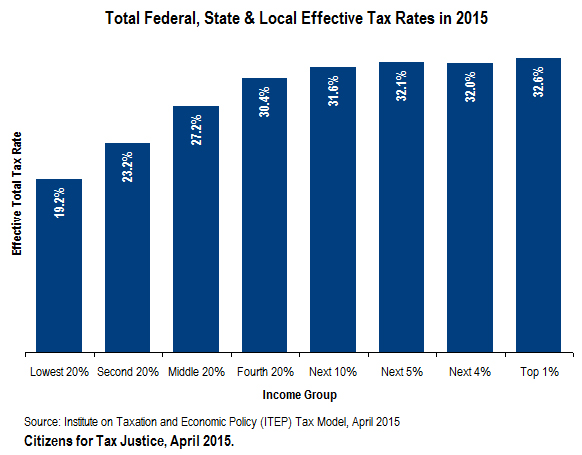

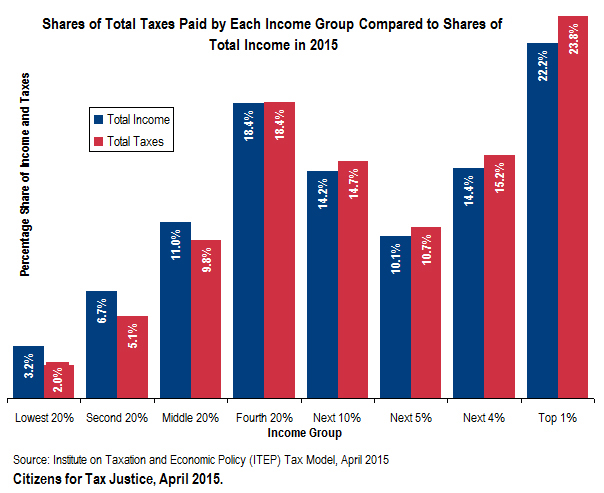

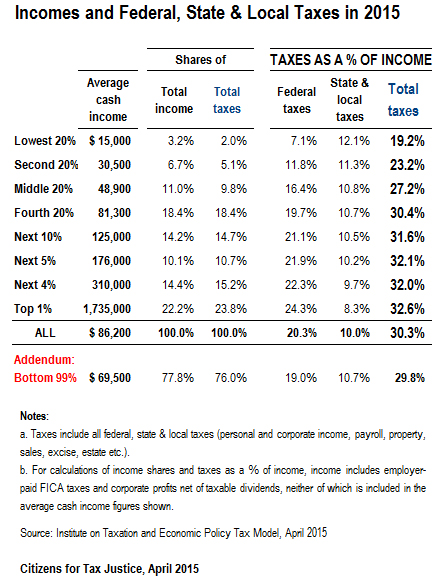

But in sum, the nation’s tax system is barely progressive. Those who advocate for top-heavy tax cuts and erroneously claim the wealthy are overtaxed focus solely on the federal personal income tax, while ignoring other taxes that Americans pay. As the table to the right illustrates, the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2015 is roughly equal to their total share of income.

But in sum, the nation’s tax system is barely progressive. Those who advocate for top-heavy tax cuts and erroneously claim the wealthy are overtaxed focus solely on the federal personal income tax, while ignoring other taxes that Americans pay. As the table to the right illustrates, the total share of taxes (federal, state, and local) that will be paid by Americans across the economic spectrum in 2015 is roughly equal to their total share of income.

Many taxes are regressive, meaning they take a larger share of income from poor and middle-income families than they do from the rich. To offset the regressive impact of payroll taxes, sales taxes and even some state and local income taxes, we need federal income tax policies that are more progressive.

Some features of the federal income tax offset the regressivity of other taxes, at least to a degree. For example, the federal personal income tax provides refundable tax credits such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can reduce or eliminate federal personal income tax liability for low-income working families and can even result in negative personal income tax liability, meaning families receive a check from the IRS.

These tax credits are only available to taxpayers who work and therefore pay federal payroll taxes. These progressive provisions do make the income tax more progressive, but overall they do little more than offset the regresssivity of other taxes that poor and middle-income families pay.

Estimates from the Institute on Taxation and Economic Policy tax model, which are illustrated in these charts and tables, include the following key findings:

■ The richest one percent of Americans pay 23.8 percent of total taxes and receive 22.2 percent of total income.

■ The poorest one-fifth of Americans pay 2.0 percent of total taxes and receive 3.2 percent of total income.

■ Each income group will pay a total share of taxes that is quite similar to each group’s total share of income.

■ Contrary to popular belief, when all taxes are considered, the rich do not pay a disproportionately high share of taxes. Although each income quintile pays combined federal, state and local taxes that are roughly equivalent to their share of the nation’s income, this by no means indicates our tax system is fine as is. In a truly progressive tax system, millionaires and billionaires wouldn’t be paying roughly the same tax rates as working families earning $100,000 per year.