April 23, 2013 11:45 PM | Permalink | ![]()

Apple & Facebook Biggest Beneficiaries of Stock Option Loophole

Earlier this year, Citizens for Tax Justice reported that Facebook Inc. had used a single tax break, for executive stock options, to avoid paying even a dime of federal and state income taxes in 2012. Since then, CTJ has investigated the extent to which other large companies are using the same tax break. This short report presents data for 280 Fortune 500 corporations that, like Facebook, disclose a portion of the tax benefits they receive from this tax break.

Earlier this year, Citizens for Tax Justice reported that Facebook Inc. had used a single tax break, for executive stock options, to avoid paying even a dime of federal and state income taxes in 2012. Since then, CTJ has investigated the extent to which other large companies are using the same tax break. This short report presents data for 280 Fortune 500 corporations that, like Facebook, disclose a portion of the tax benefits they receive from this tax break.

- These 280 corporations reduced their federal and state corporate income taxes by a total of $27.3 billion over the last three years, by using the so-called “excess stock option” tax break.

- In 2012 alone, the tax break cut Fortune 500 income taxes by $11.2 billion.

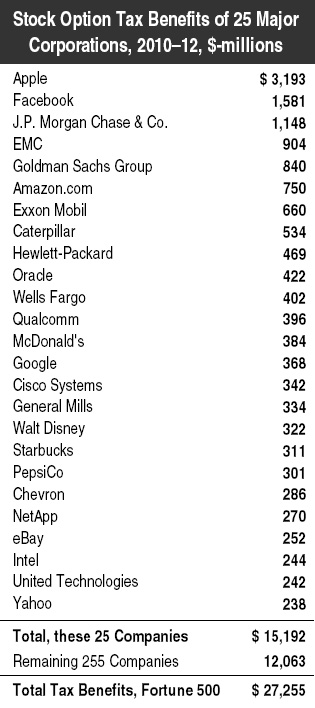

- Just 25 companies received more than half of the total excess stock option tax benefits accruing to Fortune 500 corporations over the past three years.

- Apple alone received 12 percent of the total excess stock option tax benefits during this period, enjoying $3.2 billion in stock option tax breaks during the past three years. JP Morgan, Goldman Sachs and ExxonMobil collectively enjoyed 10 percent of the total.

- In 2012, Facebook wiped out its entire U.S. income tax liability by using excess stock option tax breaks.

- Over the past three years, Apple slashed its federal and state income taxes by 20 percent using this single tax break.

How It Works: Companies Deduct Executive Compensation Costs They Never Actually Paid

Most big corporations give their executives (and sometimes other employees) options to buy the company’s stock at a favorable price in the future. When those options are exercised, corporations can take a tax deduction for the difference between what the employees pay for the stock and what it’s worth (while employees report this difference as taxable wages).

Before 2006, companies could deduct the “cost” of the stock options on their tax returns, reducing their taxable profits as reported to the IRS, but didn’t have to reduce the profits they reported to their shareholders in the same way, creating a big gap between “book” and “tax” income. Some observers, including CTJ, argued that the most sensible way to resolve this would be to deny companies any tax deduction for an alleged “cost” that doesn’t require an actual cash outlay, and to require the same treatment for shareholder reporting purposes.

But instead, rules in place since 2006 maintained the tax write-off, but now require companies to lower their “book” profits somewhat to take account of options. But the book write-offs are still usually considerably less than what the companies take as tax deductions. That’s because the oddly-designed rules require the value of the stock options for book purposes to be calculated — or guessed at — when the options are issued, while the tax deductions reflect the actual value when the options are exercised. Because companies typically low-ball the estimated values, they usually end up with much bigger tax write-offs than the amounts they deduct in computing the profits they report to shareholders.

Reforming the Excess Stock Option Tax Break

Despite the changes that took effect in 2006, the stock option tax break is still clearly reducing the effectiveness of the corporate income tax. A November 2011 CTJ report assessing the taxes paid by the Fortune 500 corporations that were consistently profitable from 2008 through 2010 identified the excess stock option tax break as a major factor explaining the low effective tax rates paid by many of the biggest Fortune 500 companies.1

In recent years, some members of Congress have taken aim at this tax break. In February of 2013, Senator Carl Levin (D-MI) introduced the “Cut Unjustified Loopholes Act,” which includes a provision requiring companies to treat stock options the same for both book and tax purposes, as well as making stock option compensation subject to the $1 million cap on corporate tax deductions for top executives’ pay.

The PDF version of this report includes the full list of 280 corporations and the size of their reported federal and state tax break for excess stock options in the three year period between 2010 and 2012.

1 Citizens for Tax Justice, Corporate Taxpayers & Corporate Tax Dodgers, 2008-2010, November 3, 2011, page 10. http://ctj.org/corporatetaxdodgers/