April 9, 2012 09:33 AM | Permalink | ![]()

Last November, Citizens for Tax Justice and the Institute on Taxation and Economic Policy issued a major study of the federal income taxes paid, or not paid, by 280 big, profitable Fortune 500 corporations. That report found, among other things, that 30 of the companies paid no net federal income tax from 2008 through 2010. New information for 2011 shows that almost all these 30 companies have maintained their tax dodging ways.

In fact, all but four of the 30 companies remained in the no-federal-income-tax category over the 2008-11 period.

Over the four years:

- 26 of the 30 companies continued to enjoy negative federal income tax rates. That means they still made more money after tax than before tax over the four years!

- Of the remaining four companies, three paid fouryear effective tax rates of less than 4 percent (specifically, 0.2%, 2.0% and 3.8%). One company paid a 2008-11 tax rate of 10.9 percent.

- In total, 2008-11 federal income taxes for the 30 companies remained negative, despite $205 billion in pretax U.S. profits. Overall, they enjoyed an average effective federal income tax rate of –3.1 percent over the four years.

“These big, profitable corporations are continuing to shift their tax burden onto average Americans,” said Citizens for Tax Justice director Bob McIntyre. “This isn’t fair to the rest of us, it makes no economic sense, and it’s part of the reason our government is running huge budget deficits.”

The Size of the Tax Subsidies:

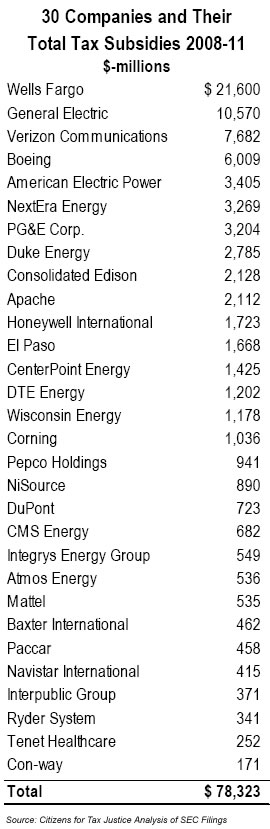

Had these 30 companies paid the full 35 percent corporate tax rate over the 2008-11 period, they would have paid $78.3 billion more in federal income taxes. Or put another way, over the four years, the 30 companies received more than $78 billion in total tax subsidies. Wells Fargo alone garnered $21.6 billion in tax subsidies over the four years, followed by General Electric ($10.6 billion), Verizon ($7.7 billion), and Boeing ($6.0 billion).

Had these 30 companies paid the full 35 percent corporate tax rate over the 2008-11 period, they would have paid $78.3 billion more in federal income taxes. Or put another way, over the four years, the 30 companies received more than $78 billion in total tax subsidies. Wells Fargo alone garnered $21.6 billion in tax subsidies over the four years, followed by General Electric ($10.6 billion), Verizon ($7.7 billion), and Boeing ($6.0 billion).

Taxes in 2011:

In 2011 alone, 24 of the 30 companies paid effective tax rates of less than 4 percent, including 15 that paid zero or less in federal income taxes in that year. For all 30 companies, the average 2011 effective federal income tax rate was a paltry 7.1% — only a fifth of the statutory 35 percent federal corporate tax rate.

The Bottom Line:

The information on these 30 companies helps illustrate why overall federal corporate income tax collections are so low. The Treasury Department reports that corporate taxes fell to only 1.2 percent of our gross domestic product over the past three fiscal years. That’s lower than at any time since the 1940s except for one single year during President Reagan’s first term. By comparison, corporate taxes averaged almost 4 percent of our GDP during the 1960s.

“Getting rid of corporate tax subsidies that cause such widespread tax avoidance ought to be a key part of any deficit-reduction program,” said McIntyre. “As a bonus, revenue-raising corporate tax reform would make it much easier to fund the investments we need to improve education and repair our crumbling roads and bridges — things that would actually help businesses and our economy grow.”

Note: The 30 no-tax corporations over the 2008-10 period reported in CTJ’s November 2011 report included Computer Sciences, which had a negative 18.3% tax rate over the three years. Computer Sciences has an odd fiscal year, and will not file its financial statements until this summer. However, in entering 2011 data for Apache, we discovered that we had missed a well-hidden entry in Apache’s financial statements for excess stock option tax benefits. Including these tax benefits lowered Apache’s effective 2008-10 tax rate from +0.6% to –1.5%. As a result, we have included Apache in the 2008-10 notax list for this updated report.

For more charts and appendixes read the PDF here.