We retired Tax Justice Blog in April 2017. For new content on issues related to tax justice, go to www.justtaxesblog.org

In what has been a cherished annual tradition for tax accountants everywhere, the day is approaching—January 1, to be precise—when dozens of temporary federal income tax provisions are set to expire. The so-called “extenders”—tax breaks enacted by Congress on a temporary basis and extended at the last minute, usually because lawmakers can’t find a way to pay for making them permanent—include a rogue’s gallery of ineffective giveaways ranging from the research and experimentation tax credit to a special write-off for race horses. One of these temporary tax breaks is an increase in the income tax exclusion for employer-provided mass transit to make it equal the existing exclusion for employer-provided parking benefits. As an NPR story recently explained, the expiration of the mass transit increase would create a glaring inequity between workers who use mass transit and those who drive: come January 1, Americans who drive to work will be able to write off $250 a month in employer-provided benefits for commuting-related costs, while those relying on mass transit will only be able to exclude $130 a month of such expenses from income.

In what has been a cherished annual tradition for tax accountants everywhere, the day is approaching—January 1, to be precise—when dozens of temporary federal income tax provisions are set to expire. The so-called “extenders”—tax breaks enacted by Congress on a temporary basis and extended at the last minute, usually because lawmakers can’t find a way to pay for making them permanent—include a rogue’s gallery of ineffective giveaways ranging from the research and experimentation tax credit to a special write-off for race horses. One of these temporary tax breaks is an increase in the income tax exclusion for employer-provided mass transit to make it equal the existing exclusion for employer-provided parking benefits. As an NPR story recently explained, the expiration of the mass transit increase would create a glaring inequity between workers who use mass transit and those who drive: come January 1, Americans who drive to work will be able to write off $250 a month in employer-provided benefits for commuting-related costs, while those relying on mass transit will only be able to exclude $130 a month of such expenses from income.

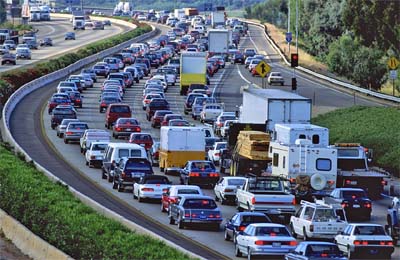

If this seems unjustifiably discriminatory, that’s because it is: there’s no defensible rationale for systematically giving car commuters a bigger tax break than those relying on mass transit. Policymakers sensibly want commuters to rely on public transit because it reduces highway gridlock and pollution—benefits that accrue to all Americans, however they get to work. No one thinks it’s a smart idea to encourage more Americans to drive to work rather than using mass transit—yet that could be the impact of allowing the mass transit subsidy to fall at year’s end.

One seemingly-obvious solution, promoted by Oregon Representative Earl Blumenauer, would maintain the status quo, which gives the exact same tax benefit for mass transit that is available for those driving to work. But this approach is disturbingly discriminatory as well: like any exclusion from the progressive federal income tax, it offers bigger benefits to the upper-income taxpayers who pay at the highest marginal rates—and offers the least to those low-income workers who earn too little to pay federal income taxes. (Since fringe benefits like parking subsidies are excluded from the federal payroll tax as well, the exclusion does offer some benefits to even the poorest workers.)

This isn’t to say that making commuting more affordable is a bad idea: for the many low-wage workers who can’t afford to live in the central cities where they work, a long and costly commute is often a harsh reality. Yet the current tax subsidies for driving and mass transit are at best an inefficient way of solving this problem. For every dollar of tax break given to a low-wage worker, these subsidies give a much bigger tax break to the best-off Americans. Allowing the temporary higher benefit for mass-transit commuters to expire would be the worst possible way of paring back this tax break. A more straightforward alternative would be to simply end all tax subsidies for costs of commuting to work and instead put this revenue toward public investment in better and more affordable transportation infrastructure.