We retired Tax Justice Blog in April 2017. For new content on issues related to tax justice, go to www.justtaxesblog.org

Last year, Texas lawmakers refused to use the state’s emergency “rainy day” fund to save education from deep spending cuts. But now that the state’s transportation system is facing the budget axe, those same lawmakers appear to have changed their tune. By the end of this week, the legislature is expected to approve a resolution asking voters to permanently divert some of the state’s rainy day funds to supplement the state’s woefully inadequate transportation revenues.

Texas has been playing a dizzying fiscal shell game, moving money back and forth between education and transportation for years, all because its regressive tax system simply brings in too few revenues to cover services its growing population needs (especially schools). The reason for Texas’ current transportation funding deficit, however, has less to do with this shell game than it does with its transportation funding sources.

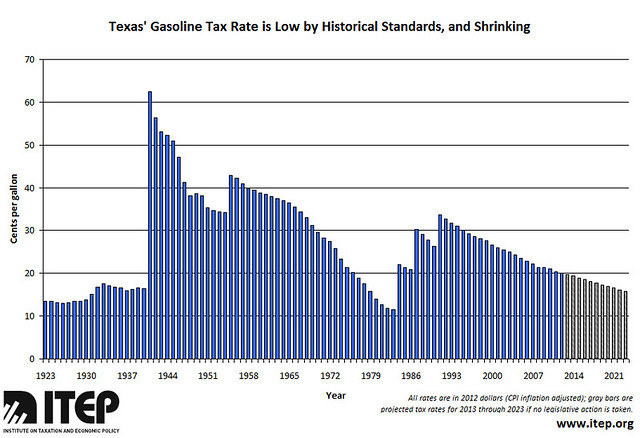

Like most states, Texas relies heavily on a “fixed-rate” gasoline tax whose revenues fall further behind each year as infrastructure costs grow and vehicles become more fuel-efficient. When we analyzed Texas’ gas and diesel taxes in 2011, we found the state could raise more than $2.1 billion in revenue per year just by updating the tax rates to catch up with the last two decades of inflation in construction costs.

This latest scheme to find money for transportation will raise less than half that much ($800 million), though, and it will do so by first transferring money away from the rainy day fund into the education fund, and then taking it from education to pay for roads. Given that Texas needs at least $4 billion in additional revenue just to maintain its current transportation network, this proposal can hardly be considered a real “solution.”

Just as importantly, this shuffling of revenues does nothing to improve the unsustainable trajectory of Texas’ transportation finances. The above chart shows that Texas’ gas tax rate has been in constant decline, as a result of inflation, since it was last raised in 1991. In fact, adjusted for inflation, Texas’ gas tax rate is at its lowest point since 1983—a full thirty years ago.