January 26, 2012 01:56 PM | Permalink | ![]()

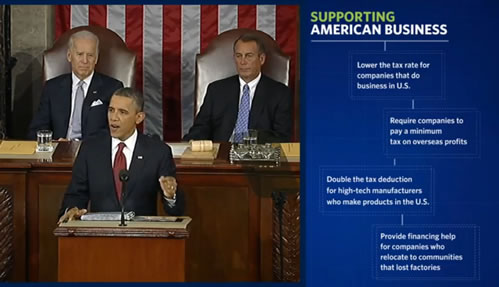

During his State of the Union address, President Obama said that “no American company should be able to avoid paying its fair share of taxes by moving jobs and profits overseas.” We couldn’t agree more. However, his proposed solutions, which the administration fleshed out with a fact sheet[1] on Wednesday, fail to raise revenue, retain and expand the loopholes that allow corporations to avoid taxes, and mark a further retreat from earlier, stronger proposals.

Raising Revenue Should Be the Main Goal of Corporate Tax Reform

The administration says it will unveil a corporate tax reform plan in February and that this plan will be “revenue-neutral,” meaning any revenue saved from closing loopholes will be given back to corporations in the form of a reduction in their tax rate or in the form of new tax loopholes. The proposals presented during the President’s speech are just a few reforms that he says Congress can act on “immediately” and are also revenue-neutral when taken together.

In a revenue-neutral reform, Congress could close loopholes that allow companies like G.E. to avoid federal taxes, but could cut taxes for a company like Walmart that currently has an effective tax rate of 30 percent. But what’s the point of getting G.E. to pay taxes if we’re just going to give the money to Walmart?

The U.S. is in desperate need of revenue to fund public services and public investments that create jobs, so any “reform” of the corporate tax that fails to raise revenue would be largely pointless.

In May, 250 organizations, including groups in every state, sent a letter urging Congress to enact a revenue-positive reform of the corporate income tax.[2] The letter explains,

Some lawmakers have proposed to eliminate corporate tax subsidies and use all of the resulting revenue savings to pay for a reduction in the corporate income tax rate. In contrast, we strongly believe most, if not all, of the revenue saved from eliminating corporate tax subsidies should go towards deficit reduction and towards creating the healthy, educated workforce and sound infrastructure that will make our nation more competitive.

CTJ also published a one-page fact sheet and a detailed report explaining why Congress should enact a revenue-positive corporate tax reform.[3]

The President Is Retreating in the Battle Over Tax Dodging

Each year, President Obama has scaled back his proposals to limit the tax break that encourages U.S. corporations to shift jobs and profits offshore.

This tax break is the loophole that allows U.S. corporations to “defer” U.S. taxes on their offshore profits until those profits are brought to the U.S. (i.e., until those profits are “repatriated”). Often these profits remain offshore for years and many U.S. corporations say they have no plans to repatriate those profits ever.

This “deferral” of U.S. taxes on offshore profits provides an incentive for U.S. corporations to shift operations and jobs to a lower tax country, or just use accounting gimmicks to make their U.S. profits appear to be “foreign” profits generated in offshore tax havens.

The only true solution is to repeal deferral,[4] but President Obama never went that far. His first budget included proposals to limit the worst abuses of deferral.[5]

The following year, the President’s budget included a scaled back version of these proposals. He notably dropped one idea to limit the arcane-sounding “check-the-box” rules that allow U.S. corporations to route profits through different countries and present conflicting information to different governments in order to avoid paying taxes to any government.

This year, the President seems to have narrowed that list just to one proposal: Prevent U.S. corporations from using “intangible” property to shift their profits into tax havens. This is a step in the right direction, but it’s certainly not sufficient.

U.S. multinational corporations can often use intangible assets to make their U.S. income appear to be “foreign” income. For example, a U.S. corporation might transfer a patent for some product it produces to its subsidiary in another country, say the Cayman Islands, that does not tax the income generated from this sort of asset. The U.S. parent corporation charges an artificially low price for the asset and will then pay artificially high fees to its subsidiary in the Cayman Islands for the use of this patent.

When it comes time to pay U.S. taxes, the U.S. parent company will claim that it’s subsidiary made huge profits by charging for the use of the patent it holds, and that because those profits were allegedly earned in the Cayman Islands, U.S. taxes on those profits are deferrable (not due). Meanwhile, the parent company says that it made little or no profit because of the huge fees it had to pay to the subsidiary in the Cayman Islands.

Part of the President’s proposal would crack down on the first step of this scheme by requiring a U.S. company to charge a more realistic price for the intangible property that it transfers to an offshore subsidiary.

Another part of the proposal would crack down the second step of this scheme by barring deferral on the income generated by the offshore subsidiary in certain circumstances. The U.S. parent company would not be allowed to defer the “excess” profits generated from the intangible asset by an offshore subsidiary in a low-tax country. Obviously, the effectiveness of this reform will depend an awful lot on how “excess profits” and “low-tax country” are defined.

Giving the Revenue Back to Corporations

Under the President’s proposals, the revenue raised from cracking down on “intangibles” would be used to offset the cost of new tax breaks. One would extend a temporary “stimulus” rule allowing companies to immediately deduct (“expense”) all investments in plants and equipment. Another would reward investment in communities hit by major job losses. Another subsidizes so-called “research” and still another cuts taxes on clean energy projects.

Some of these are among the loopholes that allowed 30 of the Fortune 500 companies to completely avoid paying corporate taxes over the past three years.[6]

A big problem with all of these breaks is that they don’t result in investment or job creation. Businesses make investments and hire people when they think that doing so will result in profit. A tax break cannot help a business to profit, because a business does not even pay taxes if it has no profits.

Taxes are a percentage of profits, so a tax cut won’t make a unprofitable company become profitable, and taxes don’t make a profitable company become unprofitable.

Tax cuts for certain activities certainly can affect decisions. For example, if we want investors to focus more on clean energy than fossil fuels, then tax breaks for clean energy are a step in that direction, although the same goal could be accomplished through direct spending instead of a tax cut.

A Minimum Tax for Offshore Corporate Profits?

The fact sheet released from the White House says that the President proposes “ensuring that all American companies pay a minimum tax on their overseas profits, preventing other countries from attracting American business through unusually low tax rates.”

The simplest way to get U.S. multinational corporations to pay taxes and end tax breaks for outsourcing would be to repeal deferral. Why does the President want these companies to pay a “minimum tax” when we could instead just require them to pay the full U.S. corporate tax that they are now avoiding through deferral?

Perhaps the most alarming possibility is that such a minimum tax could be a cover for moving in quite the opposite direction. A “minimum tax” on offshore income could describe the plan released in October by Republican House Ways and Means chairman Dave Camp to exempt almost all offshore profits of U.S. corporations from U.S. taxes. (This is often called a “territorial” tax system.)

Camp’s proposal includes a tiny tax of just 1.25 percent on offshore profits. Hopefully, this is not the “minimum tax” the President is thinking about.

[1] White House, “President Obama’s Blueprint to Support U.S. Manufacturing Jobs, Discourage Outsourcing, and Encourage Insourcing,” January 25, 2012. http://www.whitehouse.gov/the-press-office/2012/01/25/fact-sheet-president-obama-s-blueprint-support-us-manufacturing-jobs-dis

[2] Letter to Congress, May 18, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corptaxletter.pdf

[3] Citizens for Tax Justice, “Fact Sheet: Why Congress Can and Should Raise Revenue through Corporate Tax Reform,” November 3, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporatefactsheet.pdf; Citizens for Tax Justice, “Revenue-Positive Reform of the Corporate Income Tax,” January 25, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporatetaxreform.pdf

[4] Citizens for Tax Justice, “Congress Should End ‘Deferral’ Rather than Adopt a ‘Territorial’ Tax System,” March 23, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/internationalcorptax2011.pdf

[5] Citizens for Tax Justice, “Obama’s Proposals to Address Offshore Tax Abuses Are a Good Start, but More Is Needed,” May 20, 2009. https://ctj.sfo2.digitaloceanspaces.com/pdf/offshoretax20090508.pdf

[6] Citizens for Tax Justice, “Corporate Taxpayers & Corporate Tax Dodgers, 2008-2010,” November 3, 2011. http://ctj.org/corporatetaxdodgers