October 11, 2016 04:29 PM | Permalink | ![]()

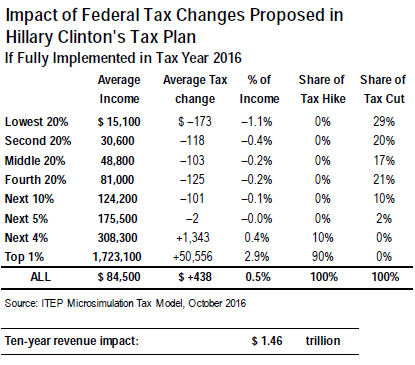

A new Citizens for Tax Justice (CTJ) analysis of the tax plan proposed by presidential candidate Hillary Clinton as of October, including recently proposed changes to the child tax credit, finds that the plan would raise federal revenues by $1.46 trillion over the next decade while providing a small tax cut on average to the bottom 95 percent of American taxpayers. The analysis also shows that those in the top 5 percent would see a significant tax increase.

Revenue Impact

Revenue Impact

Clinton’s tax proposal would increase federal revenues by $1.46 trillion over the next decade. The plan would raise $850 billion overall from the personal income tax, which includes a $1.055 trillion revenue increase coupled with the $209 billion cost of her proposals to increase the child tax credit. In addition, the plan would increase revenue from the corporate income tax by $128 billion and increase revenue from the estate tax by another $483 billion.

Distributional Impact

The Clinton plan would cut taxes overall for each income group except the top 5 percent. Individuals in the lowest 20 percent would see the greatest gain, an increase in after tax income of 1.1 percent.

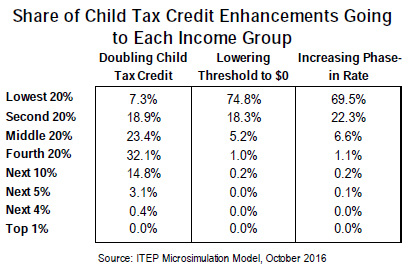

Without the child tax credit proposals, the effect of Clinton’s proposed tax changes on low- and middle-income families essentially would be zero. The inclusion of these child tax credit enhancements is the key reason the vast majority of taxpayers would receive a tax cut.

The top 5 percent would see their taxes go up significantly. On average, taxes for the top 1 percent of would increase by $50,556, while those in the 96th to 99th percentile would see their annual federal taxes increase by $1,343 on average. Under Clinton’s plan, the top 1 percent would receive 90 percent of the tax increase.

Understanding the Impact of the Child Tax Credit Changes

Understanding the Impact of the Child Tax Credit Changes

Clinton’s plan to enhance the child tax credits has three key components: it would double the maximum tax credit from $1,000 to $2,000 for each child up to age 4, lower the threshold for refundability from $3,000 to $0 and increase the phase-in rate from 15 percent to 45 percent for families with young children. Two of these provisions, the lower threshold and increased phase-in rate, would be highly progressive, with about three-quarters of the benefits of the lower threshold going to the bottom 20 percent and about 70 percent of the benefits of the increased phase-in rate going just to the bottom 20 percent of taxpayers. The provision to double the maximum credit would largely go to middle-income families.

Proposed Policy Changes in the Clinton Plan

- Personal income “surtax” of 4 percent on federal adjusted gross income (AGI) exceeding $5,000,000 ($2,500,000 for married filing separately).

- Create a “Buffett rule”-style minimum tax, a 30 percent minimum tax applying to taxpayers with AGI exceeding $1,000,000.

- Create a new variable-rate structure, based on holding periods, for long-term capital gains for high-income families, increasing tax rates on some (but not all) gains. Carried interest would no longer be eligible for special low capital gains tax rates.

- Cap the value of various tax breaks, including itemized deductions, at 28 percent.

- Expand the base of the Net Investment Income Tax (NIIT), enacted as part of President Obama’s health care reforms, to include income from “pass through” businesses.

- Restructure the federal estate tax, with new higher tax brackets and rates up to 65 percent for the largest estates.

- End the “stepped up basis” estate tax break by taxing capital gains at death, with unspecified middle-income and small business exclusions.

- Enhance the child tax credit by doubling the max tax credit from $1,000 to $2,000 for each young child up to and including age 4, lowering the threshold for refundability from $3,000 to $0 and increasing the phase-in rate from 15 percent to 45 percent for families with young children.

- End tax breaks for oil and gas companies, including the deduction for percentage depletion for oil wells, the domestic manufacturing deduction for oil companies and the expensing of intangible drilling costs.

- Reduce corporate inversions by enacting an exit tax on unrepatriated funds for expatriating companies, limiting companies’ ability to claim foreign status after a merger and restricting deductions for excessive interest.