We retired Tax Justice Blog in April 2017. For new content on issues related to tax justice, go to www.justtaxesblog.org

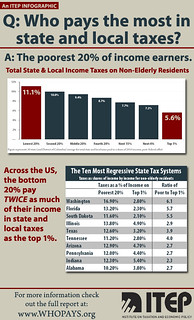

Annual state and local finance data from the Census Bureau are often used to rank states as “low” or “high” tax states based on state taxes collected as a share of personal income. But focusing on a state’s overall tax revenues overlooks the fact that taxpayers experience tax systems very differently. In particular, the poorest 20 percent of taxpayers pay a greater share of their income in state and local taxes than any other income group in all but nine states. And, in every state, low-income taxpayers pay more as a share of income than the wealthiest one percent of taxpayers.

Annual state and local finance data from the Census Bureau are often used to rank states as “low” or “high” tax states based on state taxes collected as a share of personal income. But focusing on a state’s overall tax revenues overlooks the fact that taxpayers experience tax systems very differently. In particular, the poorest 20 percent of taxpayers pay a greater share of their income in state and local taxes than any other income group in all but nine states. And, in every state, low-income taxpayers pay more as a share of income than the wealthiest one percent of taxpayers.

Our partner organization, the Institute on Taxation and Economic Policy (ITEP) took a closer look at the Census data and matched it up with data from their signature Who Pays report which shows the effective state and local tax rates taxpayers pay across the income distribution in all 50 states. ITEP found that in six states— Arizona, Florida, South Dakota, Tennessee, Texas, and Washington — there is an especially pronounced mismatch between the Census data and how these supposedly low tax states treat people living at or below the poverty line.

See ITEP’s companion report, State Tax Codes As Poverty Fighting Tools.

The major reason for the mismatch is that these six states have largely unbalanced tax structures. Florida, South Dakota, Tennessee, Texas and Washington rely heavily on regressive sales and excise taxes because they do not levy a broad-based personal income tax. Since lower-income families must spend more of what they earn just to get by, sales and excise taxes affect this group far more than higher-income taxpayers. Arizona has a personal income tax, but like the no-income tax states, the Grand Canyon state relies most heavily on sales and excise taxes.

To learn more about how low tax states overall can be high tax states for families living in poverty, read the state briefs described below:

Arizona has the 35thhighest taxes overall (9.8% of income), but the 5thhighest taxes on the poorest 20 percent of residents (12.9% of income). The top 1 percent richest Arizona residents pay only 4.7% of their incomes in state and local taxes.

Florida has the 45thhighest taxes overall (8.8% of income), but the 3rdhighest taxes on the poorest 20 percent of residents (13.2% of income). The top 1 percent richest Florida residents pay only 2.3% of their incomes in state and local taxes.

South Dakota has the 50thhighest taxes overall (7.9% of income- making it the “lowest” tax state), but the 11thhighest taxes on the poorest 20 percent of residents (11.6% of income). The top 1 percent richest South Dakota residents pay only 2.1% of their incomes in state and local taxes.

Tennessee has the 49thhighest taxes overall (8.3% of income), but the 14thhighest taxes on the poorest 20 percent of residents (11.2% of income). The top 1 percent richest Tennessee residents pay only 2.8% of their incomes in state and local taxes.

Texas has the 40thhighest taxes overall (9.1% of income), but the 6thhighest taxes on the poorest 20 percent of residents (12.6% of income). The top 1 percent richest Texas residents pay only 3.2% of their incomes in state and local taxes.

Washington has the 36thhighest taxes overall (9.7% of income), but the 1sthighest taxes on the poorest 20 percent of residents (16.9% of income). The top 1 percent richest Washington residents pay only 2.8% of their incomes in state and local taxes.