We retired Tax Justice Blog in April 2017. For new content on issues related to tax justice, go to www.justtaxesblog.org

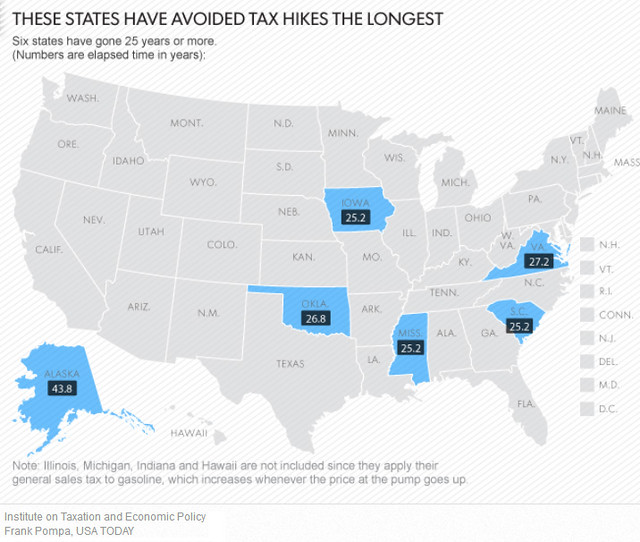

With pothole season well under way, our partner organization, the Institute on Taxation and Economic Policy (ITEP), has been in the news quite a bit recently for its research on the need for more sustainable federal and state gasoline taxes. USA Today ran a story this week featuring quotes from ITEP staff and six different infographics based on ITEP data that explain where state gas taxes are, and aren’t, being raised. In addition, ITEP’s Carl Davis appeared on both CBNC and NPR’s Marketplace to talk about the gas tax.

With pothole season well under way, our partner organization, the Institute on Taxation and Economic Policy (ITEP), has been in the news quite a bit recently for its research on the need for more sustainable federal and state gasoline taxes. USA Today ran a story this week featuring quotes from ITEP staff and six different infographics based on ITEP data that explain where state gas taxes are, and aren’t, being raised. In addition, ITEP’s Carl Davis appeared on both CBNC and NPR’s Marketplace to talk about the gas tax.

The Missouri legislature is poised to offer Kansas a truce in the never-ending battle to shower Kansas City-area companies with tax credits. Both the Missouri Senate and House recently passed similar bills that would ban state tax incentives for companies that agree to move from the Kansas side of the Kansas City border (Wyandotte, Johnson, Douglas, or Miami counties) to the Missouri side (Jackson, Clay, Platte, or Cass counties). It seems Missouri has finally realized that tax breaks used to lure companies across the border — otaling $217 million between both states in recent years by one estimate — don’t actually create new jobs for the region’s residents and would be better spent on much needed public services. The one catch: the Missouri bill would only go into effect if Kansas agrees to a similar ceasefire within the next two years.

Perhaps this is the year that Utah will establish a state Earned Income Tax Credit (EITC). A bill creating the much-heralded working family tax credit was passed out of the House Revenue and Taxation Committee last month. Last year, a similar bill was passed by the full House, but stalled in the Senate. This year’s bill, which is again sponsored by Representative Hutchings, would give over 200,000 low-income Utahns a refundable tax credit worth 5 percent of the federal EITC, or roughly $113 on average. But one change from last year’s bill is that the credit will not go into effect until Utah is allowed to start collecting sales tax from online shoppers — something that won’t happen until Congress passes legislation granting the states that power. Such a bill has already passed the U.S. Senate and is supported by President Obama, but it is still pending in the U.S. House.

While a full solution to the problem of uncollected sales taxes on online shopping will have to come from the federal government, Hawaii’s House of Representatives wants to chip away at the problem by expanding the number of online retailers that have to collect sales tax right now. Under a bill backed by the state Chamber of Commerce, retailers partnering with Hawaii-based companies to solicit sales would have to collect sales taxes on purchases made by their Hawaii customers. This move to apply the state’s sales tax laws more uniformly to both online retailers and traditional brick-and-mortar stores would be one step toward a more modern sales tax in the Aloha State.