April 15, 2013 10:09 AM | Permalink | ![]()

1. Virtually all Americans, including the poorest Americans, pay taxes.

■ When someone says almost half of Americans are not paying taxes, that refers to just one tax, the federal personal income tax, and ignores the many other taxes Americans at all income levels pay.

■ Overall, state and local taxes actually take a larger share of income from a poor family than they take from a higher-income family.

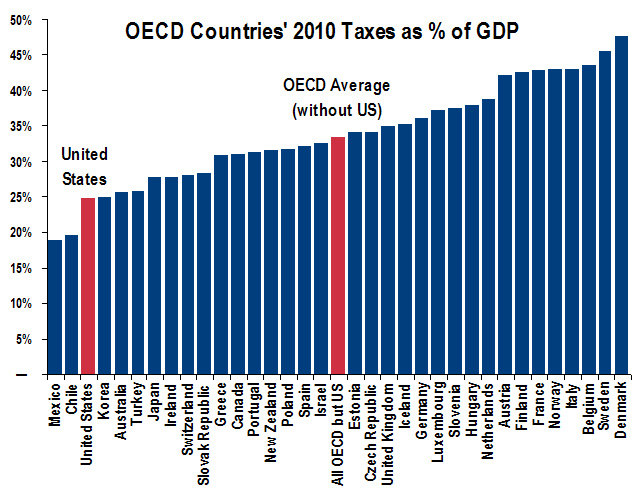

2. America is NOT overtaxed.

■ Of the world’s developed countries, only two (Chile and Mexico) collect less tax revenue as a share of their economy than does the U.S.

■ The countries collecting more in taxes, as a share of their economy, than the U.S. include our trade partners and competitors, like France, Germany, the United Kingdom, Canada, South Korea and others.

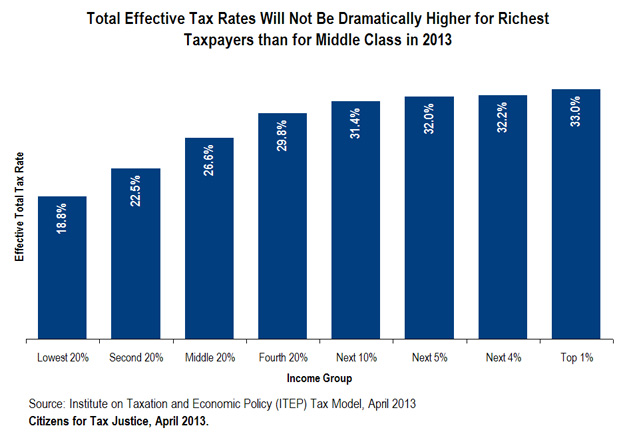

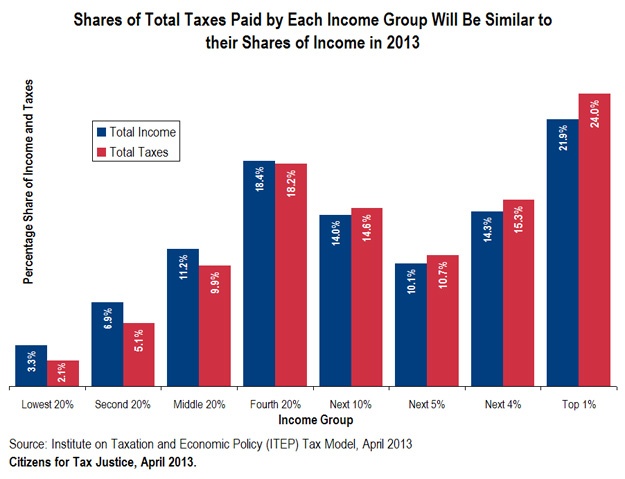

3. Wealthy Americans are NOT overtaxed.

■ When you add up all the different federal, state and local taxes that Americans pay, you find that our overall tax system is just barely progressive.

■ The richest one percent of Americans pay 24.0 percent of the total taxes in America, but they also take in 21.9 percent of the total income in America.

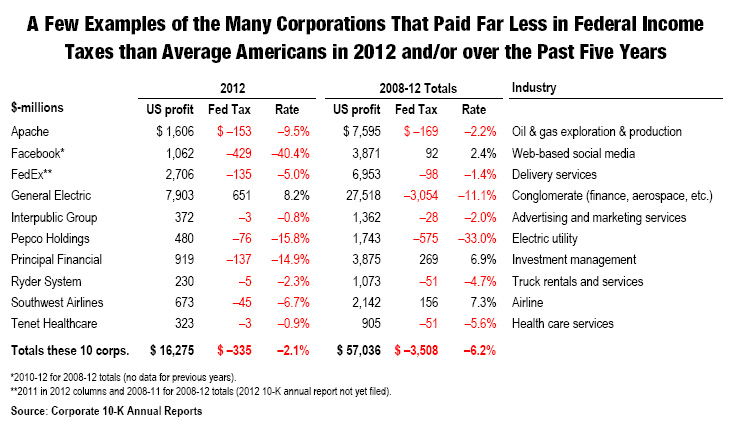

4. U.S. corporations are Undertaxed.

■ CTJ’s study of 280 profitable Fortune 500 corporations found that they on average only paid about half the official corporate tax rate of 35 percent during 2008 through 2010.

■ Many large profitable companies, including Facebook, Pepco, Southwest Airlines and others, paid nothing in corporate income taxes during 2012.

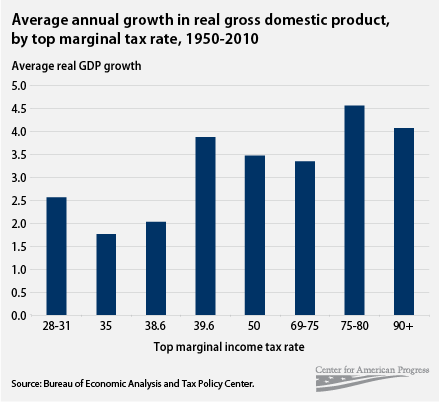

5. Tax cuts for the rich do not help our economy.

■ Using data from the past 65 years, the Congressional Research Service has found that there is no correlation between top tax rates and economic growth.

■ This conclusion holds true at the state level, where research from ITEP and academic economists has shown lowering or eliminating state income taxes to have little if any impact on state economies.

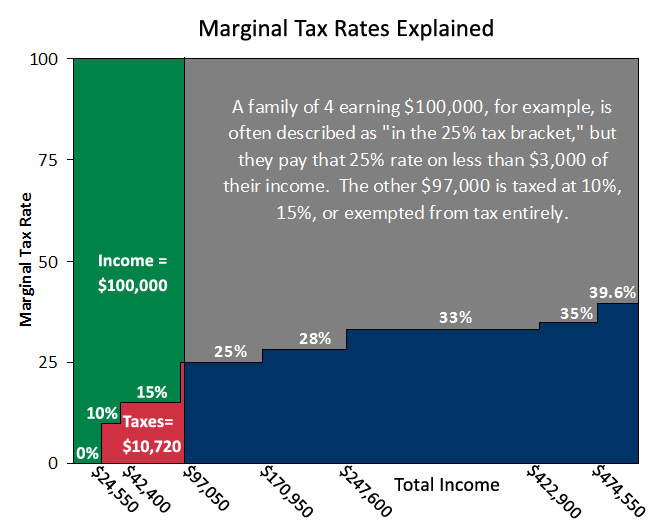

6. Your Tax Bracket is Not Your Effective Tax Rate

■ If your income grows and you find yourself “in” a higher tax bracket, your tax rate does not go up on all of your income, it only goes on the portion of you income above the specific income threshold.

■ Over 99.9% (PDF) of taxpayers pay an effective federal income tax rate of less than 30 percent, well below the top marginal tax rate.