September 15, 2014 01:30 PM | Permalink | ![]()

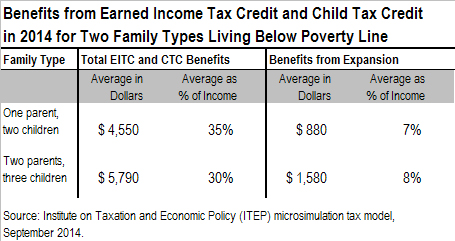

The federal Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are among the most important anti-poverty programs in America. The table below examines two types of families living below the official poverty line — those with one parent and two children and those with two parents and three children — and the impact that the EITC and CTC has on them.[1]

The table also demonstrates that a significant amount of this impact comes from an expansion in both credits, which was first enacted in 2009 and will expire at the end of 2017 if Congress does not act. The figures are estimates produced by the Institute on Taxation and Economic Policy (ITEP) microsimulation model.

The EITC is a refundable credit equal to a certain percentage of earnings (40 percent of earnings for a family with two children, for example) up to a maximum amount (a maximum credit of $5,460 for a family with two children in 2014). It is phased out at higher income levels. The CTC is a credit equal to a maximum of $1,000 per child. The refundable part of the CTC is equal to 15 percent of earnings (above a specific threshold) up to the maximum of $1,000 per child.

Both credits were expanded—temporarily—in the American Recovery and Reinvestment Act of 2009 (ARRA). The EITC was given a higher credit rate (45 percent) for families with three or more children, and the income level at which the credit begins to phase out was raised for families headed by married couples.

The CTC was adjusted so that the refundable part of the credit is equal to 15 percent of earnings above $3,000, rather than the higher threshold in permanent law (which would be $13,600 in 2014).

These expansions of the EITC and CTC have been extended several times and are now scheduled to expire at the end of 2017.

The table on the first page illustrates that the average one-parent, two-child family living below the poverty line this year will receive $4,550 from the EITC and CTC this year, which boosts those families’ incomes by a little over a third on average. Of that amount, $880 is the result of the 2009 expansions in the CTC, which boosts those families’ incomes by 7 percent on average. (The expansions of the EITC would not impact a family without married parents or three or more children.)

The table also illustrates that the average two-parent, three-child families living below the poverty line will receive $5,790 from the EITC and CTC, which boosts those families’ incomes by 30 percent on average. Of that amount, $1,580 is the result of the 2009 expansions of the credits, which boosts these families’ incomes by 8 percent.

Several empirical studies have found that the EITC increases hours worked by the poor. These studies have also found that the EITC has had a particularly strong effect in increasing the hours worked by low-income single parents, and there is evidence that it had a larger impact on hours worked than did the work requirements and benefit limits enacted as part of welfare reform.[2]

The refundable part of the CTC is likely to have similar impacts. The EITC and the refundable part of the CTC are credits equal to a certain percentage of earnings, meaning these refundable tax credits are only available to those who work.

[1] In 2014, the Census Bureau’s official poverty threshold, which is adjusted for inflation each year, will likely be roughly $19,000 for families with one parent and two children and $28,000 for families with two parents and three children.

[2] Chuck Marr, Jimmy Charite, and Chye-Ching Huang, “Earned Income Tax Credit Promotes Work, Encourages Children’s Success at School, Research Finds,” Center on Budget and Policy Priorities, revised April 9, 2013, http://www.cbpp.org/cms/index.cfm?fa=view&id=3793.