September 11, 2015 05:29 PM | Permalink | ![]()

Jeb Bush Tax Plan Turns Populism on Its Head

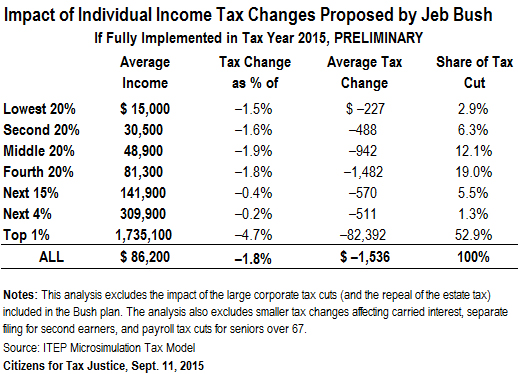

Earlier this week, presidential candidate Jeb Bush released the details of his plan to restructure personal and corporate income taxes. A new Citizens for Tax Justice analysis of the tax plan reveals that it would cut personal income taxes by more than $227 billion a year, and it would reserve the biggest tax cuts for the wealthiest 1 percent of Americans.

What the Bush Plan Would Do

Bush’s tax plan includes major changes to both the personal and corporate income taxes. CTJ’s analysis focuses on policy changes that would directly affect income taxes paid by individuals.

If Bush’s tax plan were in effect this year, the individual income tax proposals alone would reduce annual revenue by more than $227 billion. (Bush’s proposal to sharply reduce corporate income taxes and repeal the federal estate tax is not included in this estimate, but those proposed tax changes would sharply increase the annual price tag of the Bush plan and skew the tax cuts even more toward the wealthiest taxpayers.)

Every income group would see an income tax cut, on average, but the Bush plan’s income tax changes would reserve the biggest benefit, as a share of income, for the very best-off Americans. The top 1 percent would collectively see a tax cut of 4.7 percent, more than twice as big as the tax changes enjoyed by any other income group, and more than three times the tax cuts received by the poorest 20 percent of Americans. In fact, almost 53 percent of the income tax cuts would go to the top 1 percent.

- The poorest 20 percent of Americans would receive a tax cut averaging $227.

- Middle-income Americans would receive an average tax cut of $942.

- The best-off 1 percent of taxpayers would enjoy an average tax cut of $82,392.

How the Bush Plan Would Cut Taxes:

- Reduce the top personal income tax rate from 39.6 percent to 28 percent, and reduces the number of tax brackets from seven to three.

- Eliminate the 3.8 percent high-income surtax on unearned income that was enacted as part of President Barack Obama’s health care reforms.

- Eliminate the Alternative Minimum Tax, which was designed to ensure that the wealthiest Americans pay at least a minimal amount of tax.

- Cut the maximum tax rate on interest income to 20 percent, mirroring the treatment of capital gains and dividends.

- Increase the standard deduction by $5,000 for single filers and $10,000 for married couples.

- Double the size of the Earned Income Tax Credit for childless filers.

- Eliminate provisions that limit the benefit of exemptions and deductions for high-income filers.

- Eliminate the estate tax, and ends stepped-up basis for capital gains.

The plan also includes some revenue-raising provisions:

- Eliminate the itemized deduction for state and local income, property and sales taxes.

- Create a new cap on the value of itemized deductions (other than charitable contributions) so that the tax benefit from these deductions cannot exceed 2 percent of a taxpayer’s Adjusted Gross Income (AGI).

- End the special tax break for the “carried interest” income enjoyed by hedge fund managers.