September 28, 2015 04:24 PM | Permalink | ![]()

(Click here for new more comprehesive analysis)

Tax Plan Reserves Biggest Tax Cuts for the Best-off Americans

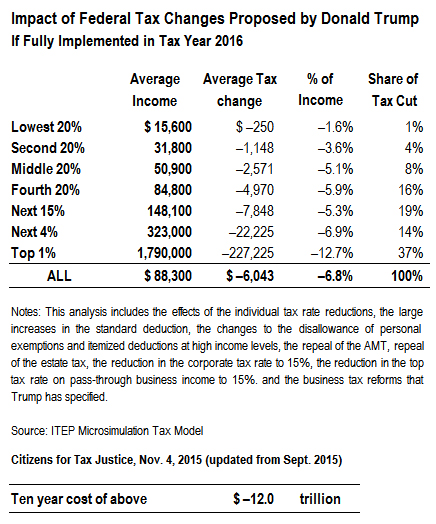

Earlier today, presidential candidate Donald Trump outlined his plan to restructure personal and corporate income taxes. A new Citizens for Tax Justice analysis of the Trump plan shows that it would cut personal income taxes by nearly $12 trillion over the next decade. While the plan would cut taxes on all income groups, by far the biggest beneficiaries would be the very wealthy.

CTJ’s analysis shows that if fully implemented in tax year 2016, Trump’s tax proposals would likely reduce revenues by almost one trillion dollars a year. Every income group would see an income tax cut, on average, under Trump’s plan:

- The poorest 20 percent of Americans would see a tax cut averaging $250.

- Middle-income Americans would see an average tax cut of just over $2,500.

- The best-off 1 percent of taxpayers would enjoy an average tax cut of over $227,000.

The best-off 1 percent would receive the biggest share of the income tax cuts under the Trump plan: fully 37 percent of the tax cuts would go to this small group of the wealthiest Americans. By contrast, the poorest 20 percent of Americans would see just 1 percent of the benefits from Trump’s tax cuts.

Proposed Policy Changes in the Trump Plan

Trump proposes to dramatically reduce personal and corporate income tax rates while offsetting a small fraction of the revenue loss by reducing or closing various tax loopholes.

The plan’s tax cuts include:

- Reduce the top personal income tax rate from 39.6 percent to 25 percent, and reduce the number of tax brackets from 7 to 3.

- Reduce the federal corporate income tax rate from 35 to 15 percent.

- Reduce the top tax rate on “pass-through” business income from 39.6 to 15 percent.

- Eliminate the 3.8 percent high-income surtax on unearned income that was enacted as part of President Barack Obama’s health care reforms.

- Eliminate the Alternative Minimum Tax, which was designed to ensure that the wealthiest Americans pay at least a minimal amount of tax.

- Increase the standard deduction to $25,000 for single filers and $50,000 for married couples.

- Eliminate the estate tax.

The plan also includes a few revenue-raising provisions:

- Phase out most itemized deductions and exemptions for high-income taxpayers more rapidly than under current law. Deductions for mortgage interest and charitable contributions would not be reduced.

- End the special tax break for the “carried interest” income enjoyed by hedge fund managers.

- End the deferral of income taxes on corporate income earned in other countries, and cap the deductibility of business interest expense.

- As a one-time revenue-raiser, Trump would impose a “deemed repatriation” tax of 10 percent (well below the 35 percent tax rate that should apply) on the more than $2.1 trillion in permanently reinvested offshore profits held by American multinationals.

- Trump also says his plan “reduces or eliminates other loopholes for the very rich and special interests…[and] some corporate loopholes that cater to special interests,” but gives no further details on these revenue raisers.

*The revenue and distributional estimate have been updated to include the report has been updated to include the impact of reducing the top tax rate on pass-through income to 15 percent. The impact of this provision increased the total revenue income from $10.8 to $12 trillion and increased the tax break for those in the top quintiles substantially.