April 5, 2012 01:27 PM | Permalink | ![]()

The U.S. Has a Low Corporate Tax: Don’t Believe the Hype about Japan’s Corporate Tax Rate Reduction

America has one of the lowest corporate income taxes of any developed country, but you wouldn’t know it given the hysteria of corporate lobbying outfits like the Business Roundtable. They say that because Japan lowered its corporate tax rate by a few percentage points on April 1, the U.S. now has the most burdensome corporate tax in the world.

The problem with this argument is that large, profitable U.S. corporations only pay about half of the 35 percent corporate tax rate on average, and most U.S. multinational corporations actually pay higher taxes in other countries. So the large majority of Americans who tell pollsters that they want U.S. corporations to pay more in taxes are onto something.

Large Profitable Corporations Paying 18.5 Percent on Average, Some Pay Nothing

Citizens for Tax Justice recently examined 280 Fortune 500 companies that were profitable each year from 2008 through 2010, and found that their average effective U.S. tax rate was just 18.5 percent over that three-year period.[1]

In other words, their effective tax rate, which is  simply the percentage of U.S. profits paid in federal corporate income taxes, is only about half the statutory federal corporate tax rate of 35 percent, thanks to the many tax loopholes these companies enjoy.

simply the percentage of U.S. profits paid in federal corporate income taxes, is only about half the statutory federal corporate tax rate of 35 percent, thanks to the many tax loopholes these companies enjoy.

Thirty of the corporations (including GE, Boeing, Wells Fargo and others) paid nothing in federal corporate income taxes over the 2008-2010 period.

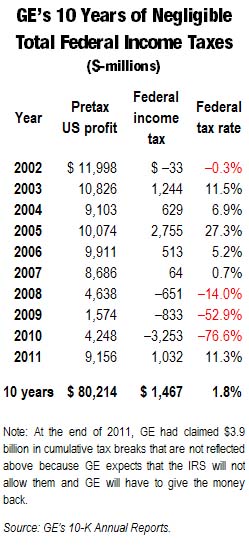

You might think that these companies simply had some unusual circumstances during the years we examined, but we find similar tax dodging when we look at previous years and the new data for 2011.

For example, GE’s effective tax rate for the 2002-2011 period (the percentage of U.S. profits it paid in federal corporate income taxes over that decade) was just 1.8 percent.[2] Boeing’s effective federal tax rate over those ten years was negative 6.5 percent, (meaning the IRS is actually boosting Boeing’s profits rather than collecting a share of them).[3]

U.S. Multinational Corporations Pay Higher Taxes in Other Countries

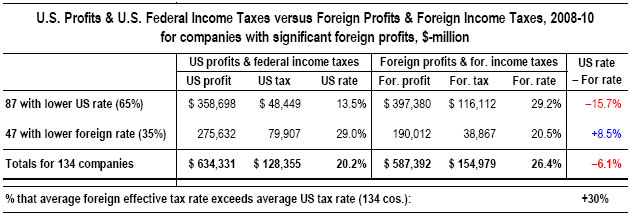

Some corporations complain that their effective tax rates are higher than we have concluded, but they are talking about their worldwide tax rates, including the taxes paid to foreign governments on profits they generate in other countries.[4] Including the foreign taxes paid makes the effective tax rate appear higher in many cases because these companies actually are being taxed at higher effective rates in the other countries where they do business.

This is extremely telling, because the entire argument of the corporate lobbyists is that the U.S. corporate income tax is more burdensome than any other corporate tax in the world. Besides, if the problem that corporations are complaining about is actually the high taxes they pay to foreign governments, how could Congress possibly provide any remedy for that? Clearly, what corporations pay in U.S. taxes is what’s relevant to the corporate tax debate before Congress.

Of the 280 corporations CTJ examined, 134 had significant foreign profits, meaning at least 10 percent of their worldwide pre-tax profits were generated outside the U.S. We found that, for 87 of these companies (about two-thirds of the companies with significant foreign profits), the effective corporate tax rate paid on U.S. profits was lower than the effective corporate tax rate paid to foreign governments on foreign profits.[5]

Of course, there are some countries that have extremely low corporate tax rates (rates of zero percent or not much higher than zero). These countries are known as tax havens, and they typically are not places where much actual business is done. Think of places like the Cayman Islands or Bermuda.

U.S. corporations engage in various dodgy accounting gimmicks to make it appear that their U.S. profits are generated by their subsidiaries in these tax havens so that they won’t be taxed. (Often these subsidiary companies consist of nothing more than a post office box a few blocks from the beach.) Eliminating the loopholes that allow these dodgy accounting gimmicks should be one of the major goals of tax reform.

Majority of Americans Are Right: Congress Should Raise Revenue by Closing Corporate Loopholes

The U.S. corporate income tax certainly needs to be reformed, but not in the way that corporate lobbyists are calling for. Congress should eliminate corporate tax loopholes and use most of the revenue savings to fund public investments and address the budget deficit.[6]

Unfortunately, most proposals to close corporate tax loopholes (including President Obama’s) would give all the resulting revenue savings back to corporations in the form of new breaks.[7] President Obama proposes a “revenue-neutral” corporate tax reform which would close loopholes and reduce the corporate tax rate to 28 percent, while some Republicans have proposed to reduce the corporate tax rate to 25 percent (even if that reduces revenues).

Unfortunately, most proposals to close corporate tax loopholes (including President Obama’s) would give all the resulting revenue savings back to corporations in the form of new breaks.[7] President Obama proposes a “revenue-neutral” corporate tax reform which would close loopholes and reduce the corporate tax rate to 28 percent, while some Republicans have proposed to reduce the corporate tax rate to 25 percent (even if that reduces revenues).

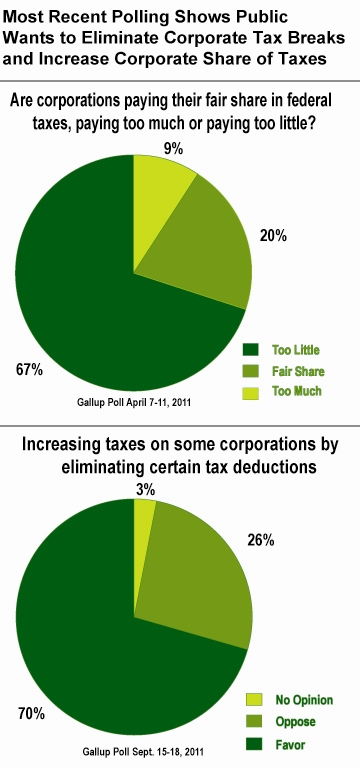

Most Americans want corporations to pay more overall in taxes than they do today. From 2004 through 2009, the Gallup Poll asked survey respondents if corporations pay their “fair share” in taxes, or if they pay “to much,” “too little,” or they’re “unsure.” Each year, anywhere from 67 percent to 73 percent of respondents said corporations pay “too little.”

In October of last year, a CBS/New York Times survey asked, “In order to try to create jobs, do you think it is probably a good idea or a bad idea to lower taxes for large corporations?” and 67 percent responded that this was a “bad idea.”

It is unclear why lawmakers have ignored their constituents’ desire for a revenue-positive reform of the federal corporate income tax. One reason may be misunderstandings about who is ultimately affected by corporate income taxes. Several empirical studies have concluded that they are ultimately borne mostly by owners of corporate stocks and business assets, who are concentrated among the richest one percent of Americans.[8]

Corporate lobbyists have argued that American workers ultimately bear the cost of corporate income taxes, because the taxes cause companies to move operations out of the United States. Even if one is unconvinced by the empirical studies leading to the opposite conclusion, common sense would suggest that corporations would not be lobbying to have corporate income taxes reduced if they didn’t believe their shareholders were the people ultimately paying them.

Whatever the reason for lawmakers’ qualms about raising corporate tax revenue, the debate over the budget deficit will force lawmakers to make a choice: Should we cut spending on things like education, infrastructure, environmental protection, and Medicaid and Medicare while doing nothing to raise corporate tax revenue? What does more to help the economy, these public investments or reductions in the corporate taxes that are ultimately paid by stockholders? The answers to these questions are pretty obvious for most Americans.

[1] Citizens for Tax Justice, “Corporate Taxpayers & Corporate Tax Dodgers, 2008-2010,” November 3, 2011. http://ctj.org/corporatetaxdodgers

[2] Citizens for Tax Justice, “General Electric’s Ten Year Tax Rate Only 2.3 Percent,” February 27, 2012. http://www.ctj.org/taxjusticedigest/archive/2012/02/press_release_general_electric.php

[3] Citizens for Tax Justice, “Obama Promoting Tax Cuts at Boeing, a Company that Paid Nothing in Net Federal Taxes Over Past Decade,” February 16, 2012. https://ctj.sfo2.digitaloceanspaces.com/pdf/boeing2012.pdf

[4] For example, GE has lately responded to news about its low U.S. effective tax rate by simply stating that its worldwide effective tax rate is 29 percent. See Citizens for Tax Justice, “GE Tries to Change the Subject,” February 29, 2012. https://ctj.sfo2.digitaloceanspaces.com/pdf/gedistraction.pdf. Large oil companies also complain about their high tax rates but almost always cite their worldwide tax rate, not their U.S. tax rate. See Kim Dixon, “Analysis: Gas Price Spike Revives Fight Over Energy Taxes,” Reuters, March 26, 2012. http://www.reuters.com/article/2012/03/26/us-usa-tax-bigoil-idUSBRE82P0DX20120326

[5] Citizens for Tax Justice, “Corporate Taxpayers & Corporate Tax Dodgers, 2008-2010,” November 3, 2011, page 10. http://ctj.org/corporatetaxdodgers

[6] A CTJ fact sheet explains why corporate tax reform should be revenue-positive. Citizens for Tax Justice, “Why Congress Can and Should Raise Revenue through Corporate Tax Reform,” November 3, 2011. https://ctj.sfo2.digitaloceanspaces.com/pdf/corporatefactsheet.pdf. A longer CTJ report has more detail. Citizens for Tax Justice, “Revenue-Positive Reform of the Corporate Income Tax,” January 25, 2011, https://ctj.sfo2.digitaloceanspaces.com/pdf/corporatetaxreform.pdf

[7] Citizens for Tax Justice, “President Obama’s ‘Framework’ for Corporate Tax Reform Would Not Raise Revenue, Leaves Key Questions Unanswered,” February 23, 2012. http://ctj.org/ctjreports/2012/02/president_obamas_framework_for_corporate_tax_reform_would_not_raise_revenue_leaves_key_questions_una.php

[8] Jennifer C. Gravelle, “Corporate Tax Incidence: Review of General Equilibrium Estimates and Analysis,” Congressional Budget Office, May 2010, http://www.cbo.gov/ftpdocs/115xx/doc11519/05-2010-Working_Paper-Corp_Tax_Incidence-Review_of_Gen_Eq_Estimates.pdf; Gravelle, Jane G. and Kent A. Smetters. 2006. “Does the Open Economy Assumption Really Mean That Labor Bears the Burden of a Capital Income Tax.” Advances in Economic Analysis & Policy vol. 6:1.